How much is car tax going up in 2022? Vehicle Excise Duty bands and rates and how much it will rise in April

and live on Freeview channel 276

Car tax is increasing from 1 April 2022, with the latest changes set to affect millions of drivers already struggling with soaring fuel and insurance costs.

Vehicle Excise Duty - to give it its correct name - is an annual charge for using your car on the road and usually increases in line with inflation every year.

Advertisement

Hide AdAdvertisement

Hide AdThis year is no different and, although it wasn’t mentioned in Chancellor Rishi Sunak’s recent Spring Statement, we know from the Autumn Budget that drivers can expect to see costs rise from April in line with the RPI inflation measure.

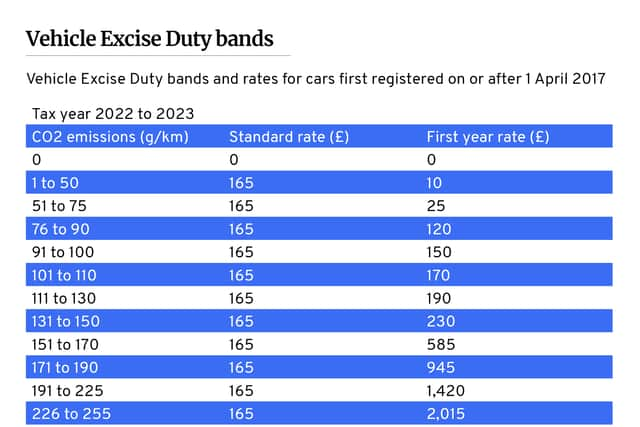

What that means for drivers depends on a number of factors, from the car’s age to its CO2 emissions and its list price.

The price paid also depends on whether it’s the car’s first year on the road.

All cars are placed into one of 13 tax bands based on their CO2 emissions. These range from zero-emissions vehicles up to cars putting out more than 225g/km and affect how much tax owners pay.

Advertisement

Hide AdAdvertisement

Hide AdFirst year rates have increased by different amounts depending on the level of emissions. For the lowest pollution cars - up to 75g/km - the rate stays the same. For those emitting up to 90g/km the increase is £5, taking first year tax to £120.

Beyond that, prices increase on a sliding scale. Between 91 and 150g/km tax rises by £10. After than it climbs by £30, £50, £75, £105 or £120. First year tax for the most polluting cars (over 255g/km of CO2) will be £2,365 in 2022/23.

After that, all cars registered after 1 April 2017 pay a flat annual rate. From 1 April 2022, that will rise from £155 to £165 for regular petrol and diesel cars, and from £145 to £155 for hybrids and cars running on LPG.

Diesel cars that are not RDE2 compliant - mostly those built before January 2021 - pay an additional £10.

Advertisement

Hide AdAdvertisement

Hide AdCars which cost more than £40,000 are also liable for the so-called “luxury tax”. This is an additional surcharge on VED charged for five years from the second year of registration. It is not increasing in 2022 and will remain at £335 per year. This fee is charged on top of the regular flat annual rate, meaning such cars are liable for a £520 annual tax bill. Zero-emissions vehicles, such as electric or hydrogen fuel cell cars, are exempt from this extra charge.

Car tax rates for older cars

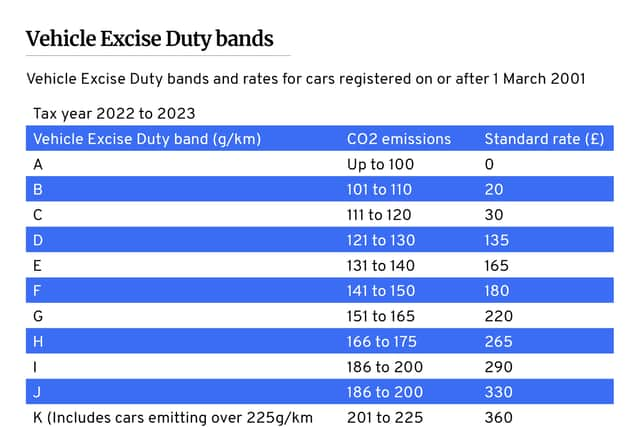

The VED rates are different for cars registered before April 2017, with different rules for cars registered between 1 March 2001 and 31 March 2017 and those registered before 1 March 2001.

Cars registered between March 2001 and April 2017 are still divided into 13 bands based on CO2 emissions. As with newer cars, the rises vary from £5 per year for lower-emissions vehicles to £30 per year for the most polluting.

Matters are simpler for cars registered before 1 March 2001. For cars with engine capacity of 1549cc or under, the annual tax rate is jumping by £10 from £170 to £180. For cars of more than 1549cc, it is going up £15 from £280 to £295.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.