ATMs: how has the Covid pandemic changed spending habits - and what does the future hold for cash machines as lockdown rules ease?

and live on Freeview channel 276

Following the reopening of shops, pub beer gardens and outside restaurant seating, town centres and high streets once abandoned during lockdown have come back to life.

Many are getting used to a new normal, from socially distanced queues and face coverings to dining outside and making contactless payments, as restrictions are relaxed further.

Advertisement

Hide AdAdvertisement

Hide AdThe closure - whether that be temporary or permanent - of many establishments due to lockdown rules has changed the way money is spent for goods and services.

Here we explore what impact those lockdowns have had on consumers’ relationship with cash, the significant reduction in the number of ATMs - and if habits have changed for good…

How has the Covid pandemic changed spending habits?

A third national lockdown brought on by the Covid pandemic starved a population of some of its favourite pastimes - until the government’s second of four phases to ease restrictions was exercised on Monday 12 April.

Lockdowns have forced a change in - or sped up - spending habits after the closure of many businesses classed as non-essential, with customers venturing online to make non-cash purchases using digital means.

Advertisement

Hide AdAdvertisement

Hide AdThe latest figures from the Office for National Statistics (ONS) show that more than a third (36.1%) of the overall amount of money spent at retailers in February 2021 went to those businesses operating online.

This figure is up from 20% a year ago - before the pandemic.

What is the rate of decline in cash payments?

An increase in spending online, coupled with more businesses using card machines and accepting contactless payments - and contactless limits increasing from £45 to £100, has there been a decline in cash use?

LINK, the UK's largest cash machine network, has seen a significant reduction in ATM transactions.

Advertisement

Hide AdAdvertisement

Hide AdGraham Mott, Director of Strategy at LINK, said: “Compared to the previous 12 months the ‘coronavirus year’ has seen the number of ATM transactions fall by 43% and the value of cash withdrawn fall by 36%. That accounts for £37 billion less cash in consumers’ pockets, purses and wallets.”

LINK’s own research found that in March 2020, 77% of people said they didn’t think Covid would affect their future use of cash - only for opinion to “completely reverse” a year on when 78% of people now say Covid will change their future use of cash.

“A trend that has emerged over the past year is that people are visiting ATMs less often,” said Mott. “But they're taking out more on each visit (£65 vs £85) and we may find that in the first couple of weeks [post lockdown], people are spending the cash they've saved over the past 12 months.”

What impact has this had on ATM use during the pandemic?

With so many places such as cinemas and shopping centres closed during lockdowns, around 3,000 ATMs went offline. Some are expected to come back online as lockdown restrictions ease, with others switched off for good.

Advertisement

Hide AdAdvertisement

Hide AdFigures show that there has been a declining trend in the number of ATMs, even before the Covid pandemic, which has been sped up over the last year due to the enforced restrictions on people’s daily lives.

Data collected by LINK shows there are 7,032 fewer ATMs in the UK than before the pandemic.

In February 2020, there were 60,248 cash machines - both free-to-use and charging machines - in operation. Fast forward 12 months and there are 53,216 in operation, a decline of 586 ATMs each month over the year.

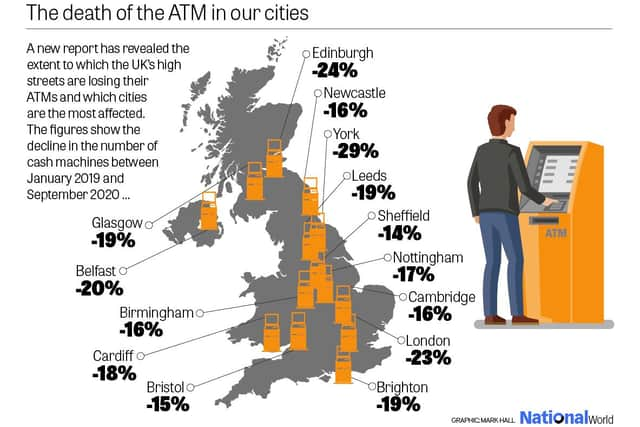

Which cities have seen the biggest reduction in ATMs?

Research carried out by payment operators Dojo showed there were regional variations to the decline, with York registering a 28% reduction in the number of cash machines or ATMs between January 2019 and September 2020.

Advertisement

Hide AdAdvertisement

Hide AdCapital cities of England, Scotland, Wales and Northern Ireland all saw major drops in the percentage of machines available, with Edinburgh suffering a 24% decline. London recorded a 23% drop, with a whopping 192 fewer ATMs.

Belfast saw its numbers decline by 20% and Cardiff 17% during the same time period - all ranking highly in the 20 UK towns and cities that closed the most cash machines in 2019/20.

Head of Customer Insights at Dojo, Jon Knott, said the increase in contactless limits allow people “more convenience to tap for their in-store purchases” and that uncapped payment limits from Apple and Google Pay is appealing to more and more people.

“During the course of the coronavirus pandemic, the makeup of the great British high street has changed enormously,” he said. “While it’s long been evolving in the face of the rising of the digital marketplace, coronavirus has reaffirmed the dominance of financial technologies.”

Have spending habits changed for good?

Advertisement

Hide AdAdvertisement

Hide AdA recent poll carried out by LINK saw that 74% of consumers said they are using less cash than they were before the pandemic, in March 2020, when around 13% of people surveyed said they were using less cash.

As restrictions begin to ease, more and more people are likely to return to town and city centres - but will consumers stick with card payments or return to using cash? LINK says a lot of it comes down to personal preference.

Mott said: “It comes down to customer choice, but we're definitely seeing more places encouraging people to pay by card. Pubs and restaurants have traditionally been quite cash heavy sectors, so we will have to see how many people will be paying for those first rounds with a card or good old cash.”

What does the future hold for cash machines?

The decline of physical cash payments is consistent but the speed of the shift towards a digitalised economy is still fluctuating - and there are people who rely on cash - such as older age groups and people working to a budget.

Advertisement

Hide AdAdvertisement

Hide AdThere was a huge reduction in ATM use in the first lockdown in March 2020, with withdrawals falling by as much as 68%, and while these numbers recovered through June, July and August - notably during the Eat Out to Help Out scheme - they have not returned to previous levels.

Mott said “several million people” still rely on cash.

“More people are comfortable shopping online and using contactless cards, so we would expect cash use to continue to decline over the next decade,” he said. “There are still several million people who rely on cash use, so it's LINK's job to make sure that people continue to have free access to cash for many years to come.”