UK workers suffer record pay slump against surging inflation, figures show

and live on Freeview channel 276

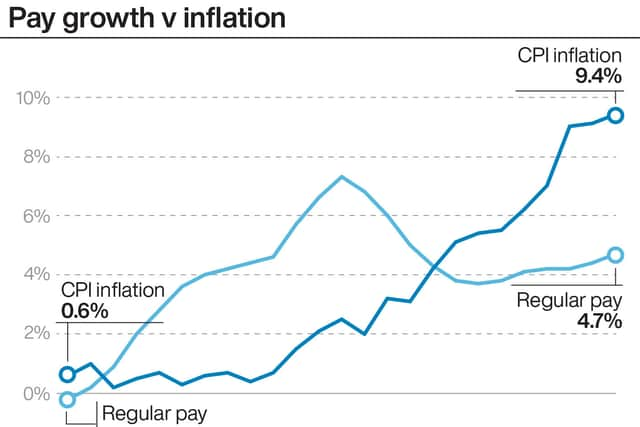

Workers in the UK saw their pay lag behind inflation at record levels over the past quarter, new figures show.

The Office for National Statistics (ONS) said regular pay - excluding bonuses - grew by 4.7% over the three months to June. Analysts had predicted that wages would increase by 4.5%.

Advertisement

Hide AdAdvertisement

Hide AdIt comes after CPI inflation hit a new 40-year record of 9.4% in June and is expected to rise even further, peaking at around 11% later this year.

‘Real value of pay continues to fall’

The ONS said this resulted in a 4.1% drop in regular pay for employees once CPI inflation is taken into account, representing the biggest slump since records began in 2001.

Figures also showed that the number of UK workers on payrolls rose by 73,000 between June and July to 29.7 million, while the unemployment rate increased to 3.8% for the quarter compared with 3.7% for the previous period.

ONS director of economic statistics Darren Morgan said: “The number of people in work grew in the second quarter of 2022, whilst the headline rates of unemployment and of people neither working nor looking for a job were little changed.

Advertisement

Hide AdAdvertisement

Hide Ad“Meanwhile, the total number of hours worked each week appears to have stabilised very slightly below pre-pandemic levels. Redundancies are still at very low levels.

“However, although the number of job vacancies remains historically very high, it fell for the first time since the summer of 2020.

“The real value of pay continues to fall. Excluding bonuses, it is still dropping faster than at any time since comparable records began in 2001.”

Vacancy numbers hit 1.274 million over the three months from May to July, slipping by 19,800 in the first signal the UK’s hot labour market could be cooling.

Advertisement

Hide AdAdvertisement

Hide AdChancellor Nadhim Zahawi said: “Today’s stats demonstrate that the jobs market is in a strong position, with unemployment lower than at almost any point in the past 40 years – good news in what I know are difficult times for people.

“This highlights the resilience of the UK economy and the fantastic businesses who are creating new jobs across the country.”

What is causing inflation to rise?

The rise in inflation in June was driven by rising fuel and food prices, which were only slightly offset by falling second-hand car prices.

The ONS said that the cost of motor fuels jumped by 42.3% in the 12 months to June, marking the biggest leap since records began.

Advertisement

Hide AdAdvertisement

Hide AdAverage petrol prices stood at 184p a litre last month, up 18.1p since May alone, while diesel raced 12.7p higher to 192.4p a litre, which was also a record.

Britons are also being hit by sharply higher grocery bills, with food and non-alcoholic drink prices having risen by 9.8% in the year to June 2022 – the highest rate since March 2009.

Food prices lifted 1.2% month on month in June, which follows similar increases in April and May as higher cost pressures and the impact of the Ukraine war filter down to supermarket shelves.

Loading....

The largest upward effect came from essential items such as milk, cheese and eggs, the ONS said, but big price rises were also seen for vegetables, meat and other food products, like ready meals.

Advertisement

Hide AdAdvertisement

Hide AdIt comes on top of huge gas and electricity tariff increases, with the annual inflation rate standing at a record 70.2% and with further rises to come.

Chancellor Nadhim Zahawi and Bank of England Governor Andrew Bailey have both pledged to get inflation under control.

However, the Bank of England is expecting inflation to rise even further in the autumn when Ofcom’s next review of the energy price cap is predicted to push it above 11%, with annual bills to cost almost £3,000.

The current cap of £1,971 is already a record which beat the previous high by 54%, but the next period, which runs from October to December, is expected to soar to £2,980.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.