What are average house prices in your area? UK property price increase and supply vs demand struggle explained

and live on Freeview channel 276

Average UK house prices have risen to a new record high of a third-of-a-million pounds, according to new figures published by Rightmove

The asking price of new properties to the market now stands at £333,564 in May 2021 - a 1.8% jump on April’s figures and a 6.7% increase on March 2020 before the Covid pandemic.

Advertisement

Hide AdAdvertisement

Hide AdNew data published by the listings website also shows that houses in Wales and the north of England have seen the sharpest rises in average asking prices, reaching into double digits.

The stamp duty holiday extension has continued to stimulate the housing market at a time when buyer demand for more space has exceeded the supply of new homes becoming available.

Here we take a look at the regional differences, varied increases of property types and the impact supply vs demand is having on current house prices.

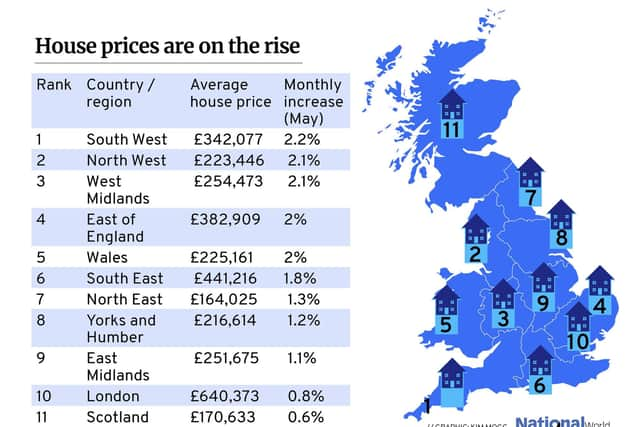

What are average house prices in your area?

London continues to be home to the most expensive houses, with the latest figures showing an average home in England’s capital will cost on average £640,373.

Advertisement

Hide AdAdvertisement

Hide AdAlthough it remains the most expensive place to live in the UK, London’s property market hasn’t seen the monthly (0.8%) or annual (0.2%) price hike experienced in other areas.

Wales has seen the biggest increase in average property prices since March 2020, with a 13% rise, followed by the North West of England (11.1%) and Yorkshire and Humber (10.5%).

Properties in the South West region, however, saw the highest increase in average house prices from April to May 2021, with a 2.2% hike, followed by the North West (2.1%) and West Midlands (2.1%).

| Country / region - average house price - monthly increase South West - £342,077 - 2.2% North West - £223,446 - 2.1% West Midlands - £254,473 - 2.1% East of England - £382,909 - 2% Wales - £225,161 - 2% South East - £441,216 - 1.8% North East - £164,025 - 1.3% Yorks and Humber - £216,614 - 1.2% East Midlands - £251,675 - 1.1% London - £640,373 - 0.8% Scotland - £170,633 - 0.6% |

What has brought on this increase in house prices?

Advertisement

Hide AdAdvertisement

Hide AdThe stamp duty holiday extension has seen a wave of people rush to move, sparked by a change in circumstances or moving up timescales to take advantage of the tax break.

The housing market experienced a “mini-boom” in 2020 which has rolled into 2021, says Rightmove’s director or property data Tim Bannister.

He said: “Buyer affordability is increasingly stretched, but there’s obviously some elasticity left to stretch a bit more as many buyers are squeezing their way into higher price bands.

“This high demand, with both willingness and ability to pay more, has pushed the average price of property coming to market to a new all-time high of a third of a million pounds.

Advertisement

Hide AdAdvertisement

Hide Ad“In another twist, it is the regions of Britain further north that are leading the way, with some degree of catching up between average prices in London and the north.”

Have all property types increased in value at the same rate?

Not all types of properties have increased in value at the same rate, with greater rises in bigger homes, according to the latest figures published by Rightmove.

First-time buyer properties, often one and two bed houses and flats, new to the market have seen a 1.2% increase from April to May and a 5.4% rise on March 2020, to £205,925.

In comparison, second-steppers, often people moving from their first home to three and four bed properties, have increased 1% from April to May and 7.9% from March 2020, to £303,000.

Advertisement

Hide AdAdvertisement

Hide AdTop of the ladder homes, typically four bed detached houses and five bed and above properties, have risen 3.1% from April to May and a 10.8% hike on March 2020, to £608,443.

Mr Bannister, from Rightmove, said there appears to be “more headroom” in buyers’ budgets among those looking to upsize, adding that family homes are “like gold dust”.

“The pandemic has changed many aspects of what people want from their homes, and the pricing pendulum is swinging away from London towards the north,” he said.

Why is demand for houses outstripping supply?

A combination of changing circumstances, such as more people working from home, new buyers entering the market and relocating are pushing demand.

Advertisement

Hide AdAdvertisement

Hide AdMark Manning, managing director of Yorkshire-based Manning Stainton, said: “Across our region we’re seeing a continued surge in the volume of new buyers entering the market.

“Of particular note is the vast number of those buyers arriving from other destinations around the country, particularly the south.

“This surge in buyer activity combined with a relative shortage of new properties coming to market has had the inevitable effect of creating a significant surge in prices with buyers clamouring to get their hands on most listings that hit the market.

“We can see little sign of this abating and would predict that even with the end of the present stamp duty incentive that prices will continue to rise through the rest of this year and likely beyond.”