What is triple lock on pensions? Annual UK state pension increase explained, and is it under threat in 2021

There have been reports that the Treasury is considering a freeze on the state pension triple lock for a year, due to concerns over the rising cost following Covid.

Downing Street has denied claims that the measure is being considered, with the Prime Minister’s spokesperson saying “we are committed to the triple lock”.

What is the triple lock?

Advertisement

Hide AdAdvertisement

Hide AdThe triple lock is a guarantee that the state pension will increase each year so that it at least matches inflation.

By at least matching the pace of inflation, the triple lock means that the pension will always be more year-on-year in real-terms.

Because there are different ways of measuring inflation, the triple-lock was introduced, which provides three different measures.

Introduced in 2010, the triple-lock means that pensions rise each year by whichever of the following three measures is the greatest:

– Average earnings growth

– Increase in prices (as per the Consumer Price Index)

– 2.5 per cent

How much is the state pension in 2021?

Advertisement

Hide AdAdvertisement

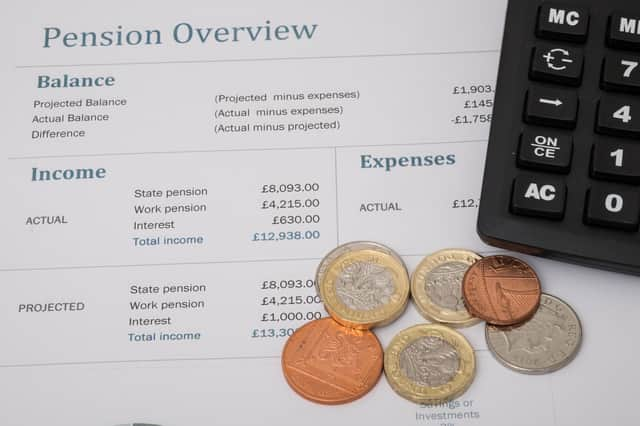

Hide AdThe full new state pension is £179.60 per week, while the basic state pension is £137.60 per week.

In order to receive the full new state pension, you have to be of pension age and either a man born on or after 6 April 1951, or a woman born on or after 6 April 1953.

Anyone who reaches the state pension age before 6 April 2016, will get the State Pension under the old rules instead.

People claiming the basic state pension are able to top this amount up, depending on the benefits accrued through their time in work.

Advertisement

Hide AdAdvertisement

Hide AdFor more information you can check the government’s website.

How much are pensions due to rise this year?

Pensions could rise to as much as £190 per week for the new state pension from 2022, if the triple lock is maintained.

Because of the distorting impact of the pandemic, average earnings growth will likely be by far the highest measure this year.

This is because it is measured against last year, when the economy was doing poorly due to the pandemic.

Advertisement

Hide AdAdvertisement

Hide AdThe most recent figures on earnings growth showed a 5.6 per cent rise, which would add £4bn to the cost of the state pension.

However, the true increase could be higher, as the rate of earnings growth figures which will decide the pensions rate are yet to be published.

There are predictions that earnings growth could be as high as 8 per cent, when the key figure is published in September.

Why would the government consider scrapping the triple lock?

While the government has now denied it is doing so, there has been speculation for some time that the triple lock may need to be abandoned, at least temporarily, due to the pandemic.

Advertisement

Hide AdAdvertisement

Hide AdSome have suggested that it is unfair to guarantee a rise in pensions well above the 1 per cent pay rise given to many public sector workers, including nurses.

Others argue that as the economic impact of the pandemic has disproportionately impacted younger people, the increased cost of maintaining the triple lock this year may be better spent elsewhere.

However, the rate of poverty among pensioners in the UK is relatively high.

Organisations such as Age UK have said that scrapping the triple lock could plunge thousands more elderly people into poverty.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.