Airport Departure Tax: what is it, how is it calculated, and why is it higher from UK airports than abroad?

and live on Freeview channel 276

When you’re going on an overseas holiday there’s many things to pay for: the flight, your hotel, your airport transfer or other travel expenses, your travel insurance. The cost of all these things can very quickly add up, so you may try to reduce costs by looking for discounted flights - even if it means travelling at unsociable hours. But there’s one cost that you can’t avoid or negotiate in any way, and you may not even realise you are paying it - Airport Departure Tax.

This is a fee that almost all people travelling from a UK airport, aged 16 or over, must pay to the government. As it’s included in the price of your airline ticket or holiday package deal it’s not immediately obvious just how much you’ve paid. The UK government is not the only government worldwide to charge people for leaving their country, but they do charge more than many other countries.

Advertisement

Hide AdAdvertisement

Hide AdSo just what is Airport Departure Tax, how much is it, how is the charge calculated and why do UK-based travellers pay so much more than those from other countries? NationalWorld has all the answers you need.

What is the Airport Departure Tax?

Airport Departure Tax (APD) is a fee charged by a country when a person is leaving that country. The tax is charged on each passenger and the amount paid is based on the class of travel and their final destination. In the UK, it applies to adult passengers aged 16 or over who are travelling on both domestic and international flights which start from UK based airports, excluding Northern Ireland and the Scottish Highlands and Islands region. APD was introduced in the UK in 1994 to offset the environmental impact of air travel.

How is Airport Departure Tax calculated?

In the UK, APD is calculated using the distance from London to the destination country's capital city, no matter which specific airport you are flying from or into.

Up to 31 March 2023, there were two bands of the tax. Band A is for flights up to 2,000 miles and band B is for flights of over 2,000 miles. A new tier of APD for international flights was introduced from April, however, which included flights over 5,500 miles. A domestic band was added for destinations in England, Scotland, Wales and Northern Ireland only. Band A remains the same, whereas band B now applies to flights that are 2,001 miles to 5,500 miles away while band C is for flights that are over 5,500 miles away. So, in summary, you will pay the least for flights within the country, a little more for short haul flights, more still for mid haul flights and the most for long haul flights.

How is Airport Departure Tax paid?

Advertisement

Hide AdAdvertisement

Hide AdHow you pay the tax depends on what country in the world you are flying from. Sometimes, for example, you can only pay the tax in the local currency, or you may only be able to pay by credit card, or by some prepayment method. In some cases, the tax may also be charged to the airlines and included in the airline ticket price. When flying from the UK, the tax is added to the price of the airline ticket. The airline then passes the fee to the government.

How much is the Airport Departure Tax?

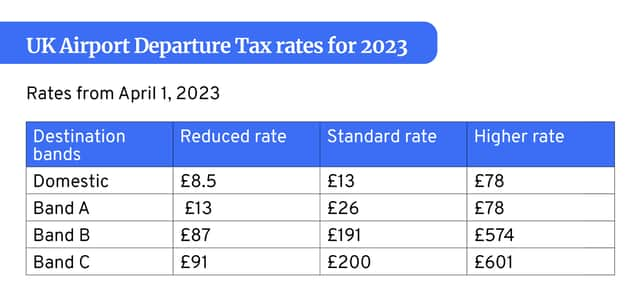

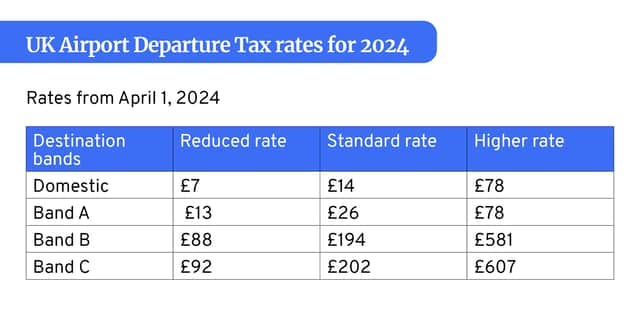

The following tables show how much APD is charged for flights in each band from 1 April 2023, and also how much will be charged from 1 April 2024.

Why is the Airport Departure Tax higher in the UK?

Since APD was introduced almost 30 years ago, the UK government has said that it helps to reduce carbon emissions. When it was first introduced the payment was simple; £5 for European flights and £10 for long-haul flights - but it’s gone up a lot since then. In fact, the UK now has an APD which is higher than many other countries, particularly for longer haul flights.

Justin Albertynas, the CEO of RatePunk, a free browser extension that helps you save money automatically by searching for hotel prices across the internet, told NationalWorld that the levels of APD across the world are determined by government policies and economic, environmental, and infrastructure factors. He says: "The APD in the UK is typically higher compared to other countries for several reasons. One factor is the UK's extensive aviation infrastructure, which requires significant investment and maintenance. Additionally, the government imposes higher taxes to fund environmental initiatives and encourage sustainable travel practices.

Advertisement

Hide AdAdvertisement

Hide Ad"These measures aim to offset the environmental impact of air travel and promote more responsible aviation”. But, he says the high level of tax is discouraging people from travelling in and out of the UK. “The UK government needs to realise that to recover after Brexit and Covid, they need to reduce the tax for the tourism and airline industry to be able to flourish”.

The below table shows how much APD is paid by passengers from flights in other countries compared to the UK, as of April 2023.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.