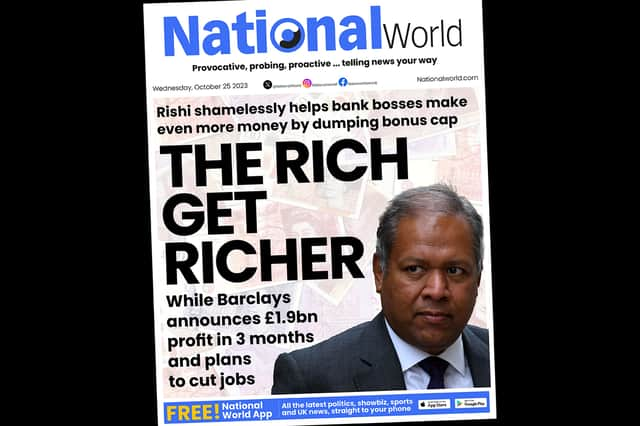

Bankers bonus cap scrapped: Rishi Sunak to abolish EU regulation on pay within weeks

Rishi Sunak is set to abolish the cap on bankers’ bonuses next week as part of a shake up of City remuneration rules, finance regulators have announced. The move comes a year after former Chancellor Kwasi Kwarteng first revealed plans to controversially scrap the rules on bonuses, inherited from the European Union (EU).

Current rules limit bonuses to twice the base rate of pay for employees of banks and building societies. The Financial Conduct Authority (FCA) and Bank of England’s Prudential Regulatory Authority (PRA) confirmed that the current bonus cap will be lifted on October 31.

The bankers bonus cap is an EU law that the UK was signed up to when it was still part of the supranational organisation. Following the UK’s decision to leave the bloc, the government transferred it across to become domestic law.

The law was first introduced by the EU following the 2008 financial crisis, when unsustainable growth by banks crashed the global economy. The cap limited additional financial rewards given to bankers on top of their regular salary.

Critics of the cap, including the former Chancellor Kwasi Kwarteng, argue it doesn’t suit the preferred financial model used by investment banks when it comes to employee salaries. City of London businesses suggest the system works better when staff are paid a lower fixed salary which is topped up with performance-based bonuses.

Finance bosses including the head of the London Stock Exchange, Julia Hoggett, also argue executive pay needs to rise to negate talent leaving the industry. Hoggett said: “The alternative is we continue standing idly by as our biggest exports become skills, talent, tax revenue and the companies that generate it.”

But not everyone is welcoming the move. Darren Jones MP, Labour’s Shadow Chief Secretary to the Treasury, criticised the government’s decision to scrap the cap on bankers’ bonuses.

“Rishi Sunak is marking his anniversary of becoming Prime Minister by pushing ahead with Liz Truss’ plan to axe the cap on bankers’ bonuses. When Truss says jump, Sunak says how high,” said Jones.

“At a time when families are struggling with the cost of living and mortgages are rising, this decision tells you everything you need to know about the priorities of this out of touch Conservative government.”

Similarly, when the plan was outlined last year, Labour said the policy would benefit corporations and the rich to the detriment of working people. Shadow chancellor Rachel Reeves said: “Bigger bonuses for bankers, huge profits for energy giants, shamelessly shielded by Downing Street, and all the while ministers pile the crushing weight of all of these costs onto the backs of taxpayers.”

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.