New tax year 2023: 5 HMRC changes you need to know about in 2023/24 - from income tax to pensions

and live on Freeview channel 276

A new tax year has arrived, with several big changes to taxes on the way that could impact your personal finances.

With the worst cost of living crisis for generations currently hitting household budgets, this new financial year is likely to get more attention than most of its predecessors. A rapid inflation rate is eroding people’s spending power, while record interest rates have driven mortgage costs hundreds of pounds higher. It means it has arguably never been more important to understand how much of your money is going to HMRC, and whether you’re eligible for any tax relief that’ll help you claw back some of your cash.

For example, ISA allowances refresh every April, which could allow you to bolster your long-term cash pot without having to pay tax on it. Meanwhile, for 2023/24, some forms of income tax relief are being uprated, which could save you hundreds of pounds a year.

It all comes after several everyday household bills were hiked at the start of April. Water bills, mobile and broadband deals as well as council tax have all gone up for consumers across the UK. A stealth increase to energy bills is also likely to be felt - although prices should go down over the summer months.

So, how are taxes and tax relief changing in the new tax year? And what does it mean for you?

What is the new tax year?

The UK tax year runs from 6 April to 5 April every year, and falls on these dates regardless of weekends or bank holidays. The reason behind why it works out this way is history. In the Middle Ages, rents would be paid to landlords at this time of year. But the start of a new financial year is a bit different these days.

Now, it defines your relationship with the government when it comes to taxation. Most planned tax changes relating to your income - for example, any alterations to national insurance or capital gains tax - usually kick in at this time of year after being announced in the government of the day’s Spring Budget.

It is also a key time for businesses, with any government changes to company taxes usually occurring in April. For this reason, firms tend to release their accounts and make changes to their operations - like implementing pay increases - in spring.

What does new UK tax year mean for me?

The 2023/24 tax year is kicking in on Thursday, and it will bring with it several big changes to taxes.

Most of these were announced by the Chancellor of the Exchequer Jeremy Hunt in his Spring Budget 2023 - although some date back to the Autumn Statement 2022 and beyond. NationalWorld will run you through all of the key things you need to know for the next 12 months:

Income tax

Back in the Autumn Statement, Jeremy Hunt announced the government would be bringing in an effective tax hike for millions of workers from April 2023.

The Chancellor has frozen the tax’s thresholds. It means people are likely to be dragged into paying more in income tax as wages are rising numerically despite falling in real terms due to high inflation.

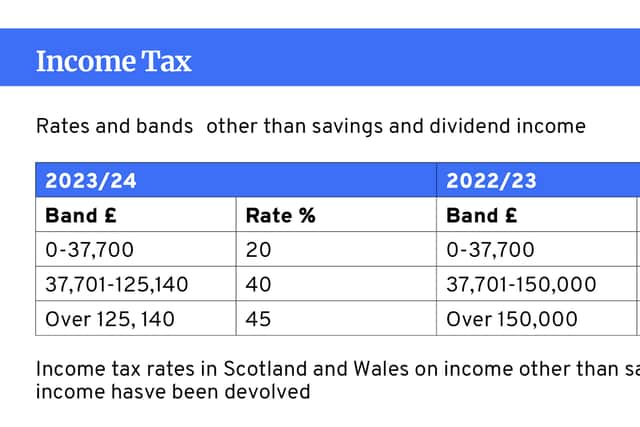

Hunt has also lowered the threshold for the top rate of the tax - known as the 45p rate because 45p in every £1 you earn above the threshold goes back to the Treasury. Having previously been set at £150,000 it has been lowered to £125,140 for the 2023/24 tax year.

The same changes also apply to Wales and Northern Ireland. In Scotland, the top rate is going up from 46% to 47%, while the higher rate is climbing from 41% to 42%.

The table below shows the PAYE tax rate above the personal threshold (i.e. the amount of income you don’t pay tax on) of £12,570. This allowance is only available to workers who make less than £125,140 per year and gradually reduces if you earn more than £100,001.

Income tax relief

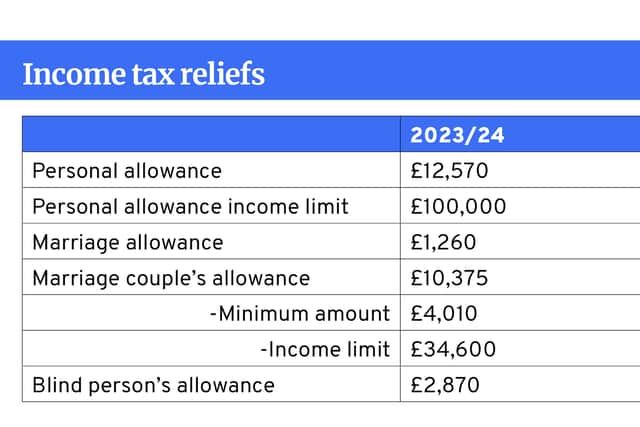

There are several ways you can claw back some of your money from HMRC - but you need to meet certain eligibility criteria. Not all of these tax reliefs are changing, but we will cover the ones that are.

First off, married couple’s allowance applies to any married couple that lives together. At least one out of the two people has to have been born before 6 April 1935 (i.e. are 88-years-old or above). The rate of the allowance has been increased (so long as the highest earner brings in less than £34,600.

It is given out at 10%, so you will be eligible for £1,037.50 a year, which reduces to the minimum rate of £401 if you earn above this threshold.

The more modern form of this relief is marriage allowance, which applies to any couple where one person is a basic rate taxpayer and the other earns below the income tax personal allowance. You also have to have been born after 6 April 1935.

Finally, blind person’s allowance is rising by £270 to £2,870 for 2023/24 in line with inflation. The table below shows all the reliefs available for income tax this year.

National insurance

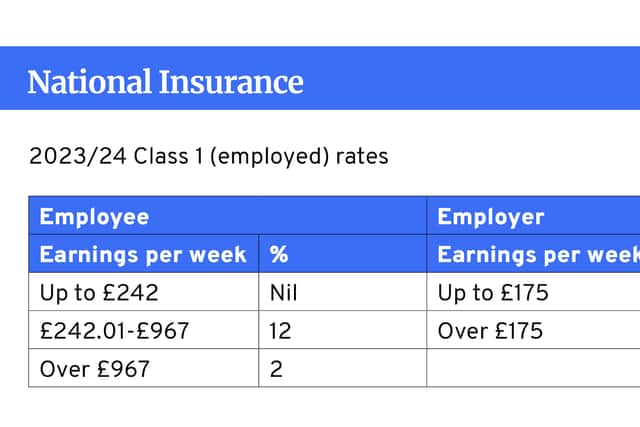

National insurance contributions (NICs) aren’t changing for 2023/24. But given the various alterations that took place in 2022, we felt it would be useful to list what they rates will be over the next 12 months.

The income threshold you have to breach before paying anything is £12,570. For any earnings you make below the higher rate of income tax (£50,270) you pay 12% in national insurance. You pay an additional 2% for anything you earn above this limit.

Employers who employ military veterans, people under 21-years-old, or apprentices under the age of 25 do not have to pay national insurance. But the rate they generally have to pay is 13.8% per employee if these workers earn more than £175 a week.

Capital gains tax

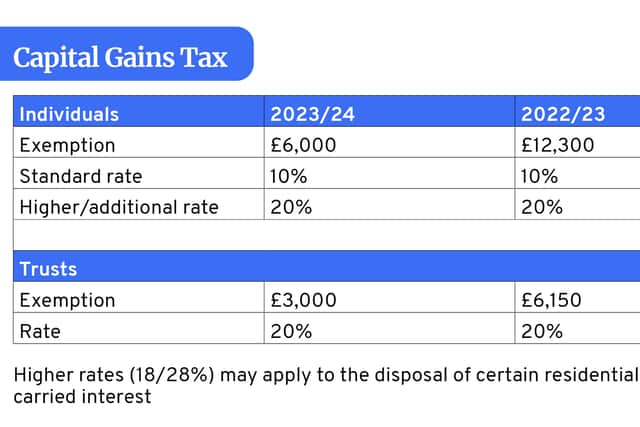

Capital gains tax (i.e. what you pay on any income you generate from the sale of certain assets) is going to be hiked for 2023/24.

In the previous tax year, any gains you made below £12,300 were exempt from tax. But this rate is now being more than halved to £6,000. If you pay the basic rate of income tax, the capital gains rate is 10%. This rises to 20% for higher band and 45p rate taxpayers.

For capital gains made from trusts, the allowance is also going to be halved - from £6,150 to £3,000. This table maps out the changes.

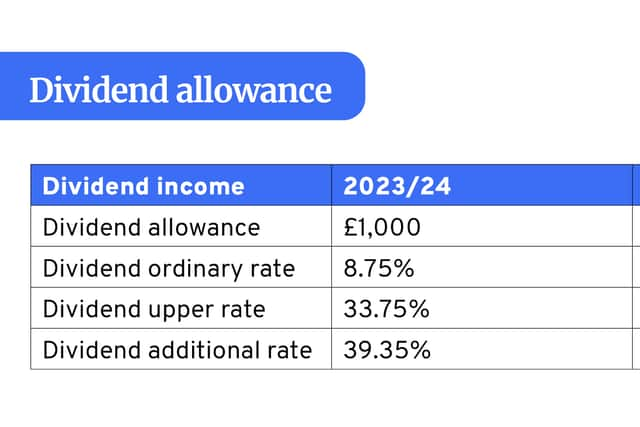

Related to capital gains tax is dividend income tax. You will receive dividend payouts if you own shares in a successful company.

The tax-free allowance on dividends is dropping from £2,000 to £1,000. The rate you will pay above this figure depends on which income tax band you fall within. These rates are not changing over the next 12 months.

Taxes on pensions

In his Spring Budget 2023, Jeremy Hunt sought to get early retirees back into the UK workforce by altering how private pensions are taxed. However, the move was criticised as it benefits the country’s highest earners.

Hunt has scrapped the lifetime allowance (i.e. the tax-free limit for the amount of pension you can have) and has upped the amount of money you can put away in a pension without paying tax on it by 50% to £60,000. If you start drawing money from your pension pot, the amount you can put into your pension without paying tax falls to £10,000.

Corporation tax

The headline rate of corporation tax is rising from 19% to 25% for companies who make profits of £250,000 or more. For those whose profits fall into the marginal threshold, you will pay a sliding scale between 19% and 25% as a result of the marginal relief fraction. But an estimated 70% of UK companies will see their corporation tax sit at the 19% rate.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.