Sharon Stone admits to losing half her fortune after Silicon Valley Bank collapse last week

People in this article

and live on Freeview channel 276

It’s not been a very good week for Hollywood A-lister Sharon Stone, who last week revealed that she had her son taken away from her during a custody battle after that infamous scene from Basic Instinct turned her into an immediate femme fatale. Now it transpires that she is one of many people who have lost money after the collapse of two US banks - Silicon Valley Bank and Signature Bank.

Addressing the crowd at a recent charity fundraiser for cancer, urging those in attendance to dig deep into their pockets, Stone admitted her pockets aren’t quite as deep anymore.

Advertisement

Hide AdAdvertisement

Hide Ad"I just lost half my money to this banking thing and that doesn’t mean that I’m not here," she admitted to the audience, not specifically referring to how she lost her money.

But with the Women’s Cancer Fund event taking place last Thursday, the collapse of both US banks last week also occurring does lend credence as to how the large sum of money disappeared. Imploring guests at last week’s gala to make donations, she also said: "I know that thing that you have to get on and figure out how to text the money is difficult. I’m a technical idiot, but I can write a f***ing cheque."

It’s been a gruelling week for Sharon Stone, after admitting last week that she lost custody of her adopted son, Roan, during a bitter divorce battle against former husband Phil Bronstein in 2003. Bronstein cited the risky nature of Stone’s previous roles as a reason to gain sole custody of the child, with the leg uncrossing scene in Basic Instinct - a scene that turned Stone into a household name - in particular leading to unfair shaming of Stone’s sexuality.

Speaking on the Table For Two podcast earlier this month, Stone said: "When the judge asked my child – my tiny little boy: ‘Do you know your mother makes sex movies?’ Like, this kind of abuse by the system – that I was considered what kind of parent I was, because I made that movie." Stone was allowed access to Roan, though custody ultimately went to the adopted father.

Who else has been affected by bad financial investments?

Advertisement

Hide AdAdvertisement

Hide AdInstagram and TikTok would have you believe that celebrities are infallible when it comes to investing their money and diversifying their portfolio. But for every Kendall Jenner, KSI or Logan Paul, there are plenty of celebrities who nearly lost everything - either by poor investments or being swindled out of their fortunes.

Mark Twain

With a lot of talk around the name Mark Twain this morning at PeopleWorld, after Adam Sandler received his Mark Twain award over the weekend, why not start with a poor financial investment by a 'celebrity' for a bygone era?

Mark Twain lost a fortune when he invested his life savings into the Paige Compositor. The doomed device was a mechanical typesetting machine invented by James Paige in the late 1800s and was so complex that it reportedly had 18,000 parts.

Sources claim that Twain invested $300,000 (over $8.5 million/£6.3 million today) into the development of the machine. Unfortunately, fewer than half a dozen machines were ever made and James Paige soon went bankrupt, taking Twain down with him.

Selena Gomez (and many more)

Advertisement

Hide AdAdvertisement

Hide AdWe could have included a whole section dedicated to the celebrities who lost a lot of money through the now infamous Ponzi scheme set up by American financier Bernie Madoff. Selena Gomez, Kevin Bacon, Steven Speilberg, John Malkovich, Zsa Zsa Gabor and Larry King were just some of the high-profile names that, much like those lower on the financial hierarchy, lost their money through this financial scandal.

In 1992, Madoff explained his purported strategy to The Wall Street Journal. He said his returns were nothing special, given that the Standard & Poors 500-stock index generated an average annual return of 16.3% between November 1982 and November 1992. "I would be surprised if anybody thought that matching the S&P over 10 years was anything outstanding." The majority of money managers trailed the S&P 500 during the 1980s.

The Journal concluded Madoff’s use of futures and options helped cushion the returns against the market’s ups and downs. Madoff said he made up for the cost of the hedges, which could have caused him to trail the stock market’s returns, with stock-picking and market timing

Justin Timberlake

We all remember when Justin Timberlake bought MySpace, looking to fill a void for musicians on social media before the advent of Instagram and TikTok. But did you know that wasn’t the only poor investment the former N’Sync member bought into at that time?

Advertisement

Hide AdAdvertisement

Hide AdAlongside paying £24 million for the old social media platform in 2011, he also invested money into the image-tagging app Stipple. We know that JT’s MySpace stake was sold to a fan four years later for the princely sum of 70p, but his other investment with the app was a loss when Stipple folded around the same time as Timberlake’s liquidation of MySpace.

Jack Nicholson

Who would want to cross Hollywood wildman Jack Nicholson when it comes to financial matters? One such brave soul managed to grift The Shining actor with his soft spot for fine art.

Nicholson was one of many Hollywood performers who invested money in Manhattan-based art dealer Tod Michael Volpe, who made his name helping celebrities build their art collections. Nicholson invested an initial £430,000 into Volpe’s art fund, but the dealer decided to invest it in other ways.

Instead, Volpe sold several paintings and even an Aston Martin he co-owned with Nicholson without telling him, pocketing the profits for himself. In 1997, Volpe was eventually arrested for defrauding his clients out of $2.5 million (£1.8m). He received a 28-month prison sentence.

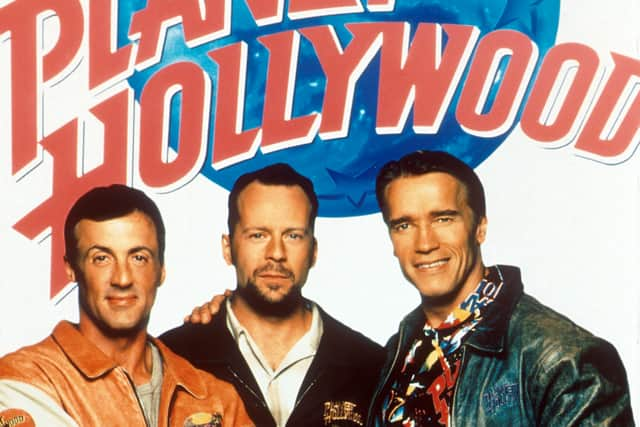

Arnold Schwarzenegger, Sylvester Stallone, Demi Moore, and Bruce Willis

Advertisement

Hide AdAdvertisement

Hide AdThese days, celebrities lending their names to products or establishments is a common occurrence, but back in the early ‘90s there was incredible fanfare for a restaurant chain called Planet Hollywood. It was set to be the Hollywood equivalent of the success the Hard Rock Cafe had found over the years and saw celebrity investors in the form of Sylvester Stallone, Demi Moore, Bruce Willis and Arnold Schwarzenegger.

It seemed fated for demise from the outset, even being parodied in the meta-action feature The Last Action Hero starring Schwarzenegger in 1993. Ultimately, it couldn’t compete with its musical counterpart, with the chain filing for Chapter 11 bankruptcy in 1999.

Schwarzenegger officially cut his ties with Planet Hollywood in January 2000, preferring to go back to how he made his millions in investments before; investing in real estate.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.