Autumn Statement 2023: the five main takeaways from Jeremy Hunt's speech - from tax cuts to housing

and live on Freeview channel 276

Jeremy Hunt said his latest budget was an "Autumn Statement for growth" as he cut national insurance and an array of business taxes.

The Chancellor introduced tough new welfare reforms, which he claimed would help 700,000 people with health conditions find jobs, and also increased the local housing allowance. He also announced both benefits and pensions would be increased in line with September's inflation figure.

The Treasury said it was able to make the announcements due to having greater "headroom" in the economy, as government debt was coming down. Rachel Reeves said in response: “What has been laid bare today is the full scale of the damage that this Conservative government has done to our economy over 13 years. And nothing that has been announced will remotely compensate."

But how will the Autumn Statement affect me? These are my five main takeaways from Jeremy Hunt's speech, and how they will affect you.

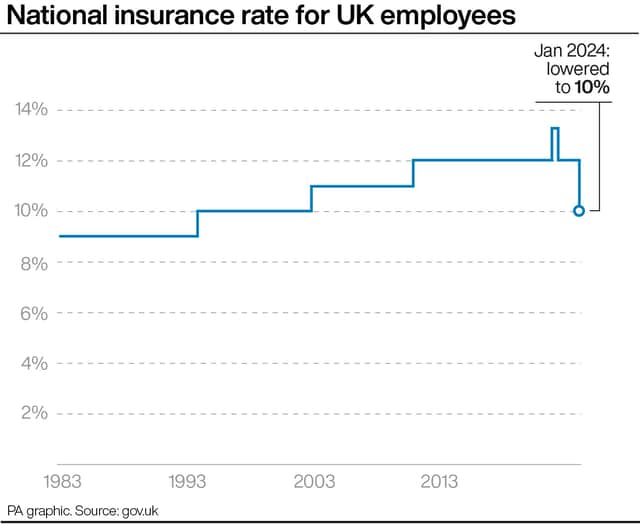

National insurance is reduced to 10%

Jeremy Hunt announced he was reducing national insurance from 12% to 10%, which will affect around 12 million people. The Treasury said that this would save the average worker, who earns around £35,000-a-year, more than £450. Hunt says he will bring in emergency legislation tomorrow to start this process, so the cut should come in from 6 January.

Hunt said high employment taxes “disincentivise the hard work we should be encouraging”, adding: "If we want people to get up early in the morning, if we want people to work nights, if we want an economy where people go the extra mile and work hard, then we need to recognise that their hard work benefits all of us."

National insurance is a tax paid by working-age people earning over £12,570. Treasury sources said that they chose this tax to cut, instead of income tax, as it is only paid by people in work and would generate growth. The health and social care levy, which was a 1.25 percentage point increase in national insurance under Boris Johnson to support the NHS, will remain in place.

Taxes aren't necessarily coming down

So this means my tax bill will come down? If you earn around the average annual salary the answer is yes, in the short-term, however this is not necessarily the case for everyone - and your tax bill may increase over the next few years.

That's because in the Spring Budget, Jeremy Hunt froze income tax bands - which work out how much tax you'll pay depending on your income. However, since then, due to inflation, wages have continued to rise pushing more people into higher income tax brackets in what is known as "fiscal drag". Many people have described this as a stealth tax, with HMRC netting an additional £27 billion in the last year because of it.

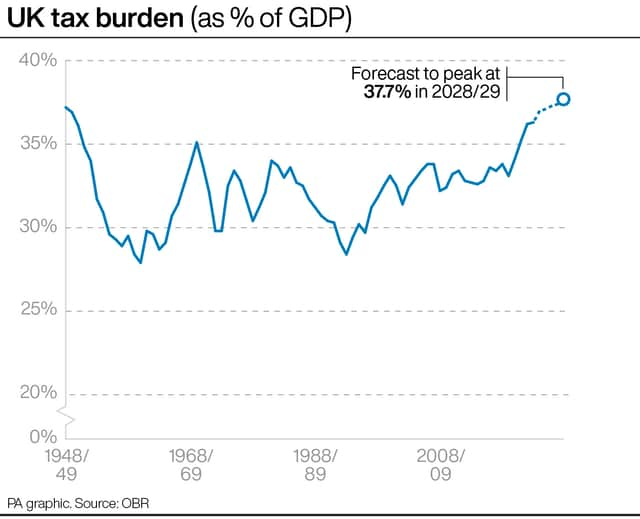

The Office for Budget Responsibility, the independent assessors of the government's fiscal plans, says this is set to raise £44.6 billion by 2028-29, with nearly four million more people paying income tax and three million more paying the higher rate.

This means that despite the tax cuts, the tax burden - the overall amount people pay on tax - will remain at the highest level since 1949, and increase over the next few years. Labour says a couple on an average wage will still be £350 worse off per year, even after today’s announcements, due to the personal allowance being frozen.

Local housing allowance increased

Jeremy Hunt ended the three-year freeze on the local housing allowance, which charities and campaigners have said has pushed many people into homelessness. The LHA is used to work out how much housing benefit and the housing proportion of Universal Credit low-income renters get.

It has been frozen since 2020, meaning that claimants have suffered a huge real-term cut to their housing support. Hunt has increased it so it covers the cheapest 30% of properties from April 2024. He said: "This will give 1.6 million households an average of £800 of support next year.”

Crisis described the housing benefit increase as “in the short-term, the single biggest step the Chancellor could take to prevent and end homelessness for tens of thousands of households”, while Shelter said it would “provide a huge sigh of relief for the 1.7 million private renters in England relying on housing benefit to help pay their rent”.

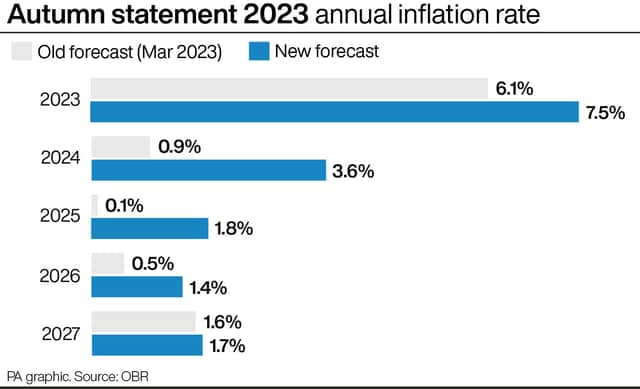

Hunt plays politics when uprating benefits

For days, briefings had been coming out of government that Jeremy Hunt was considering uprating benefits by the October inflation figure 4.6% instead of September's of 6.7% as is customary. The Chancellor was reportedly trying to find extra cash for tax cuts.

Then to the Commons, Hunt grandly announced: "I know there’s been some speculation that we would increase benefits next year by the lower October figure for inflation, but cost-of-living pressures remain at their most acute for the poorest families.

"So instead, the Government has decided to increase Universal Credit and other benefits from next April by 6.7%, in line with September’s inflation figure." He described this as compassionate conservatism. A big announcement for something that normally would have happened automatically.

Welfare crackdown

The Chancellor said he was bringing about the "biggest welfare reforms in a decade", as part of a crackdown on people who claim benefits. Hunt quoted post-pandemic figures of more than seven million adults of working age, excluding students, who are not employed, despite a million vacancies in the economy.

People who do not take a job after 18 months of looking with government help will have their benefits stopped. They will then get placed on a paid government work placement. It is unclear what kind of work this will consist of. The Treasury hopes this will grow the economy and increase productivity.

The Chancellor told the Commons: “Every year we sign off over 100,000 people on to benefits with no requirement to look for work because of sickness or disability. That waste of potential is wrong economically and wrong morally.” This got a strong reaction from MPs on the opposition benches, with Hunt described as "disgraceful".

NationalWorld understands this should not affect disabled people or parents, and it will only apply to new benefit claimants. However, the Disability Benefits Consortium, a national coalition of more than 100 charities, described the government’s plan as a “cynical attack on disability benefits (which) will have a devastating impact on those on the lowest incomes”.

Ralph Blackburn is NationalWorld’s politics editor based in Westminster, where he gets special access to Parliament, MPs and government briefings. If you liked this article you can follow Ralph on X (Twitter) here and sign up to his free weekly newsletter Politics Uncovered, which brings you the latest analysis and gossip from Westminster every Sunday morning.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.