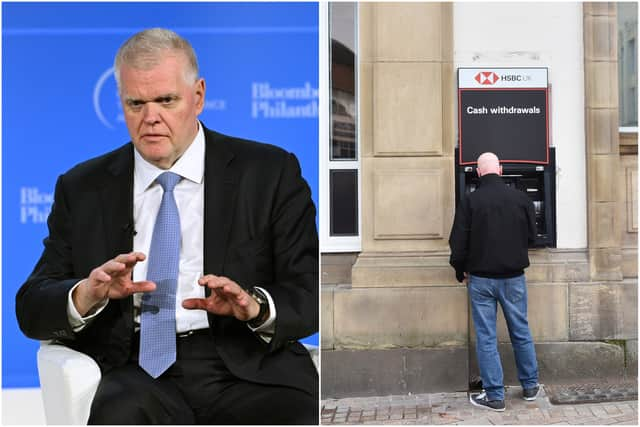

HSBC: UK banking business' record profits news, share price, how much did CEO Noel Quinn make - and dividends

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

and live on Freeview channel 276

HSBC has announced its highest-ever annual profits and a nearly doubled salary for its CEO, despite the bank's share price declining after it revealed that its financial performance suffered in recent months due to its connections with China's challenged property market.

In 2023, HSBC reported a pre-tax profit surge of almost 80%, reaching over 30.3 billion US dollars (£24 billion), compared to 17.1 billion dollars (£13.6 billion) the previous year.

Bankers for HSBC also shared bonuses worth 3.8 billion US dollars (£3 billion), surging by 12% compared with the previous year.

CEO Noel Quinn also said in a statement: "Our record profit performance in 2023 enabled us to reward our shareholders with our highest full-year dividend since 2008."

"They've had quite a sizable increase in what we call net interest margin which is the difference between the amount they charged borrowers and the amount they pay to depositors," banking analyst Frances Coppola told the BBC.

"That's really been the principal driver of the increase both in revenues and profits," she added. Here is everything you need to know about it.

How much did CEO Noel Quinn earn?

The bank also revealed in its annual report that the pay package for chief executive Noel Quinn nearly doubled last year.

He took home £10.6 million, up from £5.6 million in 2022, primarily thanks to a £5 million long-term bonus in HSBC shares that he gained during the year.

Quinn said his pay package was based on the bank’s performance. “As you can see from the numbers, 2023 was a very strong performance, and that is reflected in my own personal remuneration,” he said.

Why are HSBC's profits so strong?

The increase in HSBC's profits was attributed in part to elevated interest rates, leading to higher borrowing costs and consequently boosting earnings for the largest banks in the UK.

Fran Boait, co-executive director at Positive Money, said: “It’s safe to say HSBC didn’t earn these record profits by providing a better service to customers, given that it closed a quarter of its bank branches last year.

"These are unearned windfall profits from higher interest rates. What we’re seeing is banks profiteering from poverty, which tens of millions of households are now living in, in part due to the same high interest rates which have enriched the banks.

“To rebalance the unequal impact of high interest rates, the government must use a windfall tax on bank profits to pass all that excess money back to the struggling households it was stripped from.”

HSBC did also reveal that its earnings were 'knocked' in recent months because of problems facing China, the world’s second-largest economy. The majority of the bank’s profits are generated in Asia, although its global headquarters are in London.

Its pre-tax profit plunged by 4.1 billion US dollars (£3.3 billion) to one billion US dollars (£800 million) in the final three months of the year, compared with the same period the year before.

The fall was driven by a three billion-US dollar (£2.4 billion) hit linked to HSBC’s stake in Bank of Communications, a Chinese bank.

Lenders in China have faced a sharp downturn in the country’s commercial real estate market, which has left many developers with mounting debts. Shares in HSBC tumbled by about 7% on Wednesday (21 February) morning following the surprise fourth-quarter hit.

Quinn said the bank remains “confident on the economy in China” and the fact that leaders are working to stimulate the economy. “I did say last quarter, I thought the market had bottomed. I still believe that,” he told reporters on Wednesday.

“I also said last quarter that it would take a few years for the market to work its way through the current challenges – so I didn’t say the challenges were over.”

What is a buyback?

The London-headquartered bank also initiated a fresh $2 billion (£1.6 billion) share buyback, in addition to three previous buybacks amounting to $7 billion (£5.6 billion). Quinn said that the bank returned a total of $19 billion (£15 billion) to shareholders in the past year.

A share buyback, also known as a stock repurchase, is a corporate action where a company buys back its own outstanding shares from the open market or directly from shareholders.

This process involves the company using its own funds to purchase a specific number of its shares. By reducing the number of outstanding shares, the ownership stake of existing shareholders increases, potentially leading to an increase in earnings per share.

If a company believes its shares are undervalued, it may choose to buy them back as an investment in itself, signalling confidence in its future performance.

At the time of writing, shares in HSBC are worth £59.63, a fall of 7.39%.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.