Corporate greed has been biggest contributor to inflation since pandemic, says International Monetary Fund

Corporate greed is the main contributing factor to rising inflation in the Eurozone, one of the world’s leading financial agencies has claimed.

The stark claim from the International Monetary Fund (IMF) comes as politicians in the UK have suggested they may ignore the recommendations of public sector pay bodies in a bid to reduce inflation.

Advertisement

Hide AdAdvertisement

Hide AdLast week, Bank of England governor Andrew Bailey was criticised when he seemed to place the responsibility for rising inflation squarely on the shoulders of working people, saying that we “cannot continue to have the current level of wage increases”.

‘Firms must allow profit margins to decline’

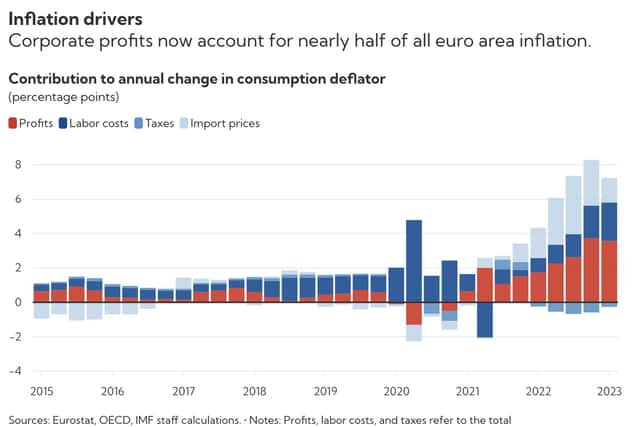

Rising corporate profits have accounted for almost half the increase in Europe’s inflation over the last two years, as companies have increased prices by more than the inflated costs of energy, according to the IMF.

The UN-body has said companies may have to accept smaller profit shares if inflation is to remain on track, as workers push for pay rises in order to keep up with inflation and recoup lost purchasing power.

Rising profits have accounted for 45% of price rises since the start of 2022, the largest factor alongside import prices (40%) and significantly higher than labour costs (25%) - taxes had a slightly deflationary impact.

Advertisement

Hide AdAdvertisement

Hide AdThis means that corporations have managed to protect their profit margins more than workers have been able to protect their earnings against rising costs.

Speaking at an event yesterday, IMF first deputy managing director Gita Gopinath said that “some wage catchup is to be expected” due to the massive real-terms decline in pay since the pandemic.

She said: “All else equal, if inflation is to fall quickly, firms must allow their profit margins—which have shot up during the past two years—to decline and absorb some of the expected rise in labour costs. But firms may resist this, especially if the economy remains resilient, while workers may demand payback for their real wage losses.”

The Bank of England’s business conditions summary shows pay settlements averaged 6-6.5% in the last quarter, though it predicted that “some companies with pay reviews due in the second half of this year thought that pay settlements could be somewhat lower,” and there were fewer reports of companies expecting to make one-off “cost of living” payments than last year.

Advertisement

Hide AdAdvertisement

Hide AdAnalysis by the trade union Unite has previously accredited the rapid rise in inflation to corporate profits, in a bid to counter the government’s preferred narrative that wage increases for workers have been the primary driver.

Government could ignore independent pay review bodies

The Prime Minister has warned he will not shy away from making decisions “people may not like” to control inflation as he again refused to commit to accepting recommendations for public sector pay rises.

Ministers have suggested they could choose to ignore advice by independent review bodies to hike public sector pay as part of UK Government attempts to calm the rate of rising prices — an option the Prime Minister has refused to take off the table.

Rishi Sunak has set halving inflation by the end of the year as his top priority ahead of a likely general election in 2024. But inflation has stayed stubbornly high, with the Consumer Prices Index (CPI) inflation remaining at 8.7% in May despite experts forecasting it would fall.

Advertisement

Hide AdAdvertisement

Hide AdPay review body recommendations are not legally binding on the Government and, although they are typically accepted, ministers can generally choose to reject or partially ignore the advice. But this would be a controversial move after the Government defended last year’s below-inflation pay rises by saying it had followed the bodies’ advice. It could further inflame ongoing disputes with unions and lead to more industrial action.

Kate Bell, assistant general secretary of the Trades Union Congress (TUC), said any decision to ignore pay review body advice would be “driven by politics, not economics”.

She said public sector wages had fallen “well behind inflation” and that there had been a “15-year wage squeeze where wages haven’t kept up with inflation”.

“We had the Government, back in the winter when they were refusing to negotiate with NHS workers — eventually, of course, they did come to the table — relying very heavily on the pay review bodies, saying we had to take into account this independent process,” she told BBC Radio 4’s Today programme.

“It is a bit rich to hear them now saying, ‘Well, we’re going to overturn those independent recommendations’ when we haven’t even seen them be published yet.”

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.