Why have gas prices gone up? Rising energy costs explained, and how it could impact food supply and bills

and live on Freeview channel 276

Soaring gas prices have plummeted the UK into an energy crisis, with fears over whether the poorest households will be able to heat their homes this winter.

Energy companies are struggling to stay afloat, with some - including Utility Point and People’s Energy - already going bust.

Advertisement

Hide AdAdvertisement

Hide AdThe gas price hike has also resulted in CO2 shortages for food suppliers.

The government is exploring ways to support the UK’s most vulnerable households this year, while it considers offering state-backed loans to encourage surviving energy companies to take on customers from firms that have gone bust.

But what is causing the rising gas prices, will electricity bills increase - and how long will the crisis last? This is what you need to know.

Why are gas prices rising?

Prices of wholesale gas are at a record high around the world as economies recover from the Covid pandemic.

Advertisement

Hide AdAdvertisement

Hide AdAccording to Industry group Oil & Gas UK, wholesale prices for gas are up 250% since January, and have increased 70% since August.

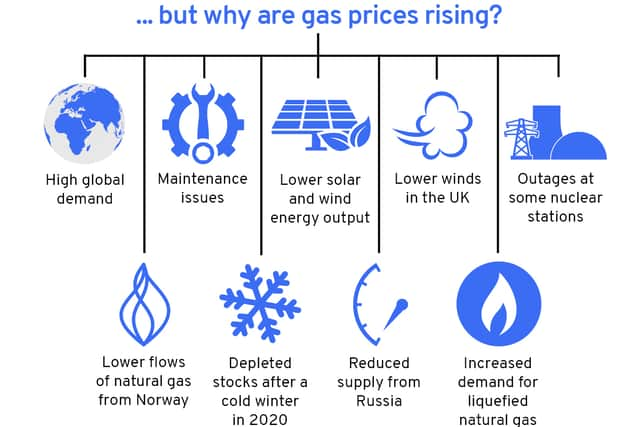

High global demand, as well as maintenance issues and lower solar and wind energy output has pushed prices up.

In the UK, lower winds have meant less renewable energy is generated. There have also been outages at some nuclear stations and lower flows into the UK of natural gas from Norway.

Dermot Nolan, a former Ofgem chief executive, said the increases were the result of depleted stocks following a cold winter in 2020, as well as reduced supply from Russia, and increased demand for liquefied natural gas from the Far East.

Why is there a CO2 shortage in the UK?

Advertisement

Hide AdAdvertisement

Hide AdThe hike in gas prices has resulted in CF Industries’ two large fertiliser plants in Teesside and Cheshire being forced to shut down.

Since Carbon Dioxide is a by-product of fertiliser production, the plant closures have impacted CO2 supply for the food industry and other manufacturers.

British Meat Processors Association chief executive Nick Allen said CO2 is essential to both the humane slaughter of livestock and extending the shelf-life of products.

How is the food industry being impacted?

Christmas dinners could be “cancelled” due to the shortage of carbon dioxide gas (CO2), the owner of the UK’s biggest poultry supplier has said.

Advertisement

Hide AdAdvertisement

Hide AdRanjit Singh Boparan, the owner of Bernard Matthews and 2 Sisters Food Group, says this, combined with a shortage of workers, will affect the supply of turkeys for Christmas.

CO2 is essential to the humane slaughter of livestock, extends the shelf-life of products and is vital to cooling systems for refrigeration purposes, industry leaders have said.

It is also used in dry ice format to keep food fresh in storage, or while being transported.

Some soft drinks producers are also facing a shortage, but have plans to help maintain their businesses according to the British Soft Drinks Association.

Advertisement

Hide AdAdvertisement

Hide AdAccording to Food and Drink Federation chief executive Iain Wright, shoppers may notice that products are missing from shelves at the end of the month, with poultry, pork and bakery goods expected to be affected.

He said: “We probably have about 10 days before this gets to the point where consumers, shoppers and diners notice that those products are not available.”

Where does the UK get its gas supply?

According to the government, about half of the UK’s gas supply is produced at home.

Business Secretary Kwasi Kwarteng said: “Our largest single source of gas is from domestic production, and the vast majority of imports come from reliable suppliers such as Norway. We are not dependent on Russian oil and gas.”

Advertisement

Hide AdAdvertisement

Hide AdGiven the volatile nature of global gas prices, the UK has plans to build up its renewable energy sector to reduce its reliance on fossil fuels.

Kwarteng said: “Renewable energy has quadrupled since 2010, but there is more to do.”

Speaking on Sky News’s Trevor Phillips on Sunday programme on 19 September, shadow economic secretary to the Treasury Pat McFadden, said: “Certainly the direction of travel must be that we decrease our reliance on fossil fuels, we increase our use of renewables.

“The future is renewables and sustainable energy and that’s where we’ve got to get to.”

Advertisement

Hide AdAdvertisement

Hide AdThe government has been criticised for not seeing the gas crisis coming.

Labour MP Anna McMorrin (Cardiff North) told MPs: “We relied far too heavily on gas most recently. It didn’t have to be this way. The Government could have foreseen it. We see that countries that have prioritised low carbon energy are far more insulated from shocks like this and protect those vulnerable families as we head to winter.”

She called for an autumn budget that ensures the UK can deliver an “ambitious, diverse, secure green energy sector at speed”.

Will energy bills rise?

There are fears that the rise in wholesale gas prices will result in bills soaring for customers.

Advertisement

Hide AdAdvertisement

Hide AdThe government’s energy price cap protects customers from sudden price surges, meaning there’s a maximum price a supplier can charge you per unit of electricity and gas.

However, the energy cap only applies if you are on a standard variable tariff (SVT), which is usually a provider’s most expensive tariff. You will normally be on an SVT unless you’ve switched within the past year.

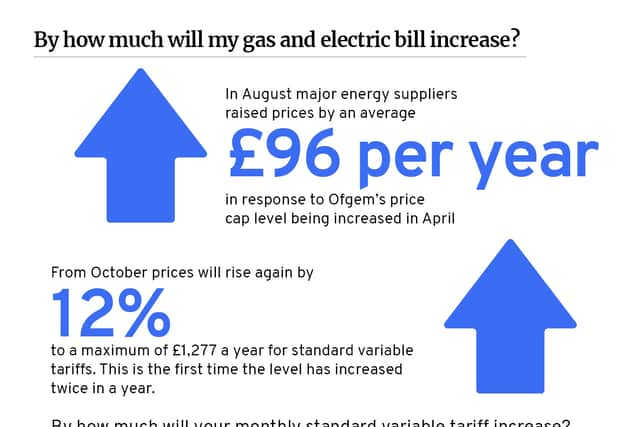

Already, millions of households across the country are facing a 12% rise in their energy bills from October, when a higher price cap comes into force.

Since wholesale energy costs have increased, the new cap has risen sharply by £139, and is now set at £1277 per year.

Advertisement

Hide AdAdvertisement

Hide AdAnd according to researchers at Cornwall Insight, a market intelligence agency, prices looks set to rise by a further £178 per year from April next year as gas prices soar.

This would be a rise to £1,455 for the six months from the beginning of April - or 14% more than the already record-breaking £1,277 that customers will pay between October and April, and up £317 from current levels.

Business Secretary Kwasi Kwarteng did not rule out the energy price cap rising in April next year.

Speaking on BBC Breakfast, he was asked whether the cap could rise again once the current period expires, and he said: “There are always fears that the price cap may go up, but, of course, it can also go down.

Advertisement

Hide AdAdvertisement

Hide Ad“We don’t know, frankly, what the gas price is going to be in six months’ time.”

Which energy companies are in trouble?

Energy companies can’t pass on the rising cost of gas to consumers, which is forcing some companies out of business.

In recent weeks, small energy companies including People’s Energy, Utility Point, PfP Energy and MoneyPlus have stopped trading.

British Gas has agreed to take on People’s Energy’s 350,000 domestic customers, according to Ofgem.

Advertisement

Hide AdAdvertisement

Hide AdAvro Energy and Green Supplier Limited have become the fourth and fifth energy suppliers to go out of business in September.

Bulb, the UK’s sixth largest energy company, is in talks with investors while a potential merger with another company within the industry is also on the table, reports the Financial Times.

As a fairly new energy supplier founded in 2015, there has been customer concern over the future of Octopus Energy Group. However its founder Greg Jackson reassured customers the company is here to stay.

Business Secretary Kwasi Kwarteng is holding crisis talks with energy suppliers. The government is considering offering loans to help surviving energy providers take on the customers from firms that have gone bust.

Advertisement

Hide AdAdvertisement

Hide AdHe told Sky News that the government would not be using tax-payers’ money to prop up “companies which have been, let’s face it, badly run.”

The government has agreed to pay out tens of millions of pounds to CF Industries, the US company which owns the fertilisers plants that closed down in Cheshire and Teesside due to the soaring wholesale gas prices.

The firm supplies 60% of the UK’s food-grade carbon dioxide.

Questions have been raised over why the UK government is using taxpayers’ money to bail out a US company owned by a millionaire.

Advertisement

Hide AdAdvertisement

Hide AdA government spokesperson has said that this is a “short-term arrangement”, and that details of the amount being paid to CF industries cannot be disclosed because it is “commercially sensitive”.

CF Industries is restarting operations only at its Teesside location, which is expected to provide enough CO2 to supply the UK’s needs.

What happens if my energy supplier goes bust?

If your supplier does go bust, you will be automatically switched to a new tariff with a new supplier.

This is a new payment plan agreed with energy regulator Ofgem, but it could be more expensive than the deal you had with your former supplier which collapsed.

Advertisement

Hide AdAdvertisement

Hide AdOfgem will make sure a household affected by the collapse of a supplier will continue to be supplied and will not lose money owed to them if they’ve been paying bills through a direct debit.

A new energy supplier is also responsible for taking on a customer’s credit balances.

When will gas prices go down?

A former head of regulator Ofgem has warned that the UK is likely to face high energy prices for the rest of the year.

On 18 September, Dermot Nolan, a former Ofgem chief executive told the BBC Radio 4 Today programme: “It is not obvious to me what can be done in the very short run. Britain does have secure relatively diverse sources of gas, so I think the lights will stay on.

Advertisement

Hide AdAdvertisement

Hide Ad“But I am afraid it is likely in my view that high gas and high electricity prices will be sustained for the next three to four months.

“It is very difficult to see what the Government can do directly in this regard.”

A message from the editor:

Thank you for reading. NationalWorld is a new national news brand, produced by a team of journalists, editors, video producers and designers who live and work across the UK. Find out more about who’s who in the team, and our editorial values. We want to start a community among our readers, so please follow us on Facebook, Twitter and Instagram, and keep the conversation going. You can also sign up to our newsletters and get a curated selection of our best reads to your inbox every day.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.