Early retirement: how the Covid pandemic has prompted a rush to retire early - and how much you need to do it

and live on Freeview channel 276

The Covid pandemic has had a lasting effect on many people’s working arrangements - not least workers nearing retirement age.

Rules and restrictions on daily life, used to suppress the spread of the disease, have meant the majority of the UK workforce have had to work from home.

Advertisement

Hide AdAdvertisement

Hide AdSome have had to negotiate the complexities of coronavirus secure workplaces while others have had to face the deadly virus on the frontline in hospitals and care homes.

Plans have been altered, for both employers and employees, as companies took up government support such as the furlough scheme to help with mounting financial pressures.

There have been closures and redundancies, business proposals ripped up and rewritten, and timeframes moved in response to the measures taken to restrict Covid.

Among all the chaos, workers are asking questions too - from work-life balances and part-full time work, to what to look for in a job and when to scale back, or even retire.

What impact has the pandemic had on retirement plans?

There is no greater plan for many than the one to retire.

Advertisement

Hide AdAdvertisement

Hide AdResearch conducted by financial service company Hargreaves Lansdown shows that the Covid pandemic has forced people to make a decision on their retirement plans.

The number of people who say they want to give up work between the age of 50 and state pension age has more than doubled from 4% to 10%, according to HL figures.

However, the number of people who said they wanted to carry on working full time increased at twice its previous rate - from 38% to 42% - in the same survey and time period.

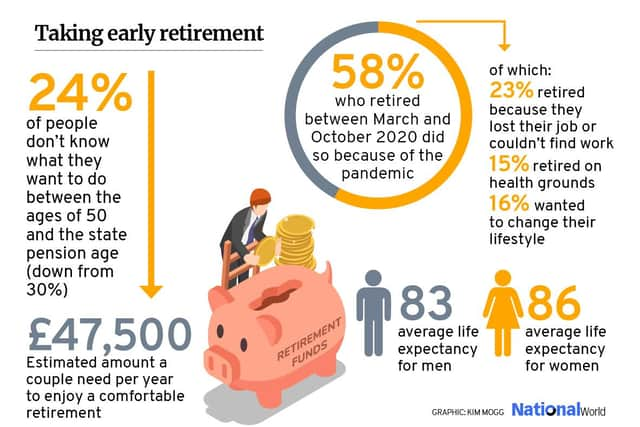

Before the crisis, almost one in three people said they didn’t know what they wanted to do between the ages of 50 and retirement (30%), which has fallen to less than one in four (24%).

Advertisement

Hide AdAdvertisement

Hide AdIt means there has been an increase in the number of people who plan to retire early AND in the number of people who want to retire later than originally planned since the Covid pandemic.

While the number of people in the middle, who were previously unsure, has reduced.

Why has the pandemic prompted a retirement rush?

Reasons for retirement are wide ranging and often unique to the individual.

The Financial Conduct Authority (FCA) found that almost three in five (58%) people who retired between March and October 2020 did so because of the pandemic.

Advertisement

Hide AdAdvertisement

Hide AdThe figures published by the FCA, UK’s independent financial regulator, showed that 23% retired because they lost their job or couldn’t find work and 15% retired on health grounds.

One in six realised they needed to change their lifestyle.

Of course there is a difference between wanting to retire early and being able to retire early.

Sarah Coles, personal finance analyst at Hargreaves Lansdown, urged people thinking about retirement to decide “when and how you want to finish work, where and how you want to live”.

“The best advice is always to save as much as you can afford to for retirement, as soon as you can afford to do so,” she said.

Advertisement

Hide AdAdvertisement

Hide Ad“Use a pension calculator to work out what kind of lump sum you need to build, and whether you need to change your contributions in order to hit your target early.”

How much do I need to retire?

The Pension and Lifetime Savings Association reckons a couple will need £47,500 a year for a comfortable retirement, but that will depend on your own plans.

While, generally, life expectancy ages are rising, with the latest Office for National Statistics (ONS) data showing men are living to 83 and women to 86 on average.

Experts say, because of this, it is essential workers save enough to last well into old age.

Advertisement

Hide AdAdvertisement

Hide Ad“Leaving your pension untouched, and your savings invested, for just a few years longer could dramatically increase your retirement income in later life. And when you do eventually retire, try to keep withdrawals to a minimum and only take out what you need,” said Romi Savova, CEO of online pensions provider PensionBee.

What are some top tips for retiring early?

For many workers an early retirement holds the promise of spending more time doing the things they enjoy, from seeing more of friends and family to seeing more of the world.

“The thought of retiring early can seem like a fairytale, but it doesn’t have to be. Whatever your life stage, there are a few simple tricks that can ensure you’re saving enough to comfortably retire, perhaps even earlier than you expect,” said Ms Savova, who outlined five key areas to consider when thinking about retirement.

“Consolidation is key,” she said. “An important first step is to consider consolidating any old pensions you may have into one pension. This will make your savings easier to manage and help prevent you from losing track of your hard-earned money from previous jobs.

Advertisement

Hide AdAdvertisement

Hide Ad“In addition, you’ll only pay fees on one larger pension pot, rather than paying multiple fees on a range of smaller pots. Try using PensionBee’s Do I have a pension? tool to help assess how likely you are to have an old pension in just a few minutes.”

Pension contributions, calculator and patience

A second tip for workers is to increase pension contributions.

“A little can go a long way in terms of pension savings so, if you can, try increasing your current level of contributions by an additional one or two percent of your salary,” said Ms Savova.

“Over time, the compound interest you’ll earn on your savings could have a significant impact on your pension pot by the time you decide to retire.

Advertisement

Hide AdAdvertisement

Hide AdThirdly, online pension calculators can help workers calculate future salaries and decide how much is needed to be able to retire at different ages.

Setting short-term saving goals can also help increase your overall retirement pot.

Ms Savova said: “Saving for your retirement is a marathon, not a sprint. It can be overwhelming to think about how much you’ll need to put aside to be able to afford the lifestyle you’d like in retirement, so for now, think short-term and put a savings plan in place that you can comfortably stick to.”

Lastly, Ms Savova also recommends letting your pension grow.

Advertisement

Hide AdAdvertisement

Hide Ad“Before you commit to taking an early retirement, ask yourself if you have any other sources of income besides your pension. While you can legally access a personal or workplace pension from the age of 55 (57 from 2028), it doesn’t always mean you should,” she added.