Cladding scandal: what is the cladding crisis and how are leaseholders affected - everything you need to know

and live on Freeview channel 276

The cladding scandal was brought to public attention following the Grenfell Fire disaster in June 2017 which claimed 72 lives.

The tragedy triggered calls for changes to UK building regulations and the removal of unsafe cladding material on tower blocks across the country.

Advertisement

Hide AdAdvertisement

Hide AdDespite this, many people continue to live in unsafe and unsellable homes.

Here’s everything you need to know about the cladding scandal.

What is the cladding scandal?

The Grenfell Tower disaster exposed the dangers of inflammable cladding on tower blocks and led to calls for this material to be removed from all residential buildings.

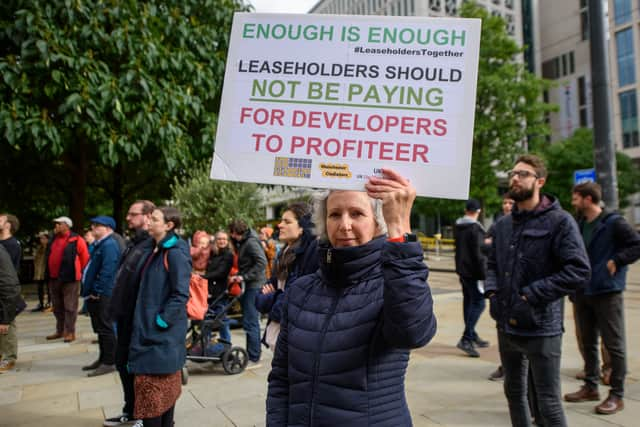

The scandal has affected tens of thousands of leaseholders in England and Wales who not only still live in buildings that have cladding but are also forced to pay expensive cladding costs, often taking out personal loans to cover the cost of work.

Advertisement

Hide AdAdvertisement

Hide AdAside from cladding, inspections have uncovered other fire defects in buildings, with properties needing fire alarms, missing fire breaks, and issues with balconies and compartmentation.

Flat owners have been left with spiralling insurance costs, service charges and requirements for expensive 24-hour “waking watch” patrols in case of a fire.

What is cladding and how does it affect flat owners?

Cladding is the process of adding a new layer of material to the outside of a building to increase insulation, weather protection or improve the appearance.

But some cladding has been found to be combustible.

The cost of making a block of flats safe is meant to be absorbed by the owners of the whole building (and the land) - the freeholder.

Advertisement

Hide AdAdvertisement

Hide AdHowever, the cost is often passed on to the owners of the individual flats - leaseholders.

Leaseholders have to pay for extra fire safety measures until the cladding is stripped off.

The cost runs into thousands of pounds and makes it very difficult for the flat-owners to sell their property because some lenders are refusing to offer mortgages on them.

Insurance premiums have also soared, and some homeowners fear potential bankruptcy.

Are there non-cladding related building safety issues?

Advertisement

Hide AdAdvertisement

Hide AdThe cladding crisis is part of a building safety issue, which has come about due to the heightened scrutiny around building regulations in the UK in the wake of Grenfell.

Following inspections under the revised regulatory regime, many tower blocks and other properties have been found to have flaws which at the time the building was built were either within regulation or not picked up on.

One of the major types of flaw these buildings tend to have is external cladding, but there are a variety of other, non-cladding issues which still render many buildings unsafe and unsellable.

The government has been criticised for failing to offer support to leaseholders who live in buildings with non-cladding related fire safety issues, who face massive remediation bills and increased costs.

What has the Government done since Grenfell?

Advertisement

Hide AdAdvertisement

Hide AdThere has been a national ban on using combustible cladding on new buildings and mandatory sprinklers on new-builds over 11m.

For buildings between 11m and 18m, the Government announced a loan scheme to help pay for cladding removal but Michael Gove said this has been paused.

For buildings over 18m, a £5 billion fund, called the Building Safety Fund, was set up to finance the removal of dangerous cladding from thousands of tower blocks in England.

The new levy is to be paid for by a new tax on the residential property sector from 2022.

Advertisement

Hide AdAdvertisement

Hide AdThe Government said the height distinction is based on the level of risk, with buildings between 18m and 30m high four times as likely to have a fire with “serious casualties.”

Currently, only leaseholders in buildings above 18m can access the grants to remove unsafe cladding.

Campaigners have urged the Government to help protect leaseholders in all buildings from the steep costs of cladding and non-cladding issues.

Until now, those living in buildings under 18m have been neglected, campaigners say, and put into an unfair loan scheme. Meanwhile those in buildings under 11m have been completely ignored in the Government’s plans.

Advertisement

Hide AdAdvertisement

Hide AdHousing secretary Michael Gove announced on Monday (10 January) that the loan scheme for buildings between 11m and 18m will be scrapped. The remediation costs for cladding on these buildings are to be met with the £5bn already promised by government and an additional £4bn from developers and construction companies.

“The Government must do more to provide certainty on risk assessment and prioritisation on buildings of all heights with both external and internal safety issues and this must include funding for a proportionate approach, whether that be remediation or risk mitigation or a combination of both,” Giles Grover, the co-leader of the End Our Cladding Scandal campaign, said.

“Ultimately, we need transparency and complete honesty - the Government will continue to try to avoid responsibility for this crisis but it knows that only it has the power to save us,” he added.

Mr Grover commented the £5bn funding is “nowhere near enough” and “still left leaseholders on the hook for the majority of costs”.

Advertisement

Hide AdAdvertisement

Hide Ad“Even with this funding, we remain very concerned that the application process is not fit-for-purpose and must be redesigned to ensure that all buildings are finally made safe at true and measurable pace.”

What’s been said?

Flat owners making applications to the fund say there is very slow progress, with a generic email address making it even more difficult to apply.

Despite the fund, campaigners have long urged the Government to accept that buildings both under and over 18m should be covered and more money is required to cover the costs.

Mr Gove, the new Secretary of State for Housing, Communities and Local Government, has recently questioned why leaseholders have to pay anything.

Advertisement

Hide AdAdvertisement

Hide AdHe told Sky News: “We want to say to developers and to all those who have a role to play in recognising their responsibility that we want to work with them.

“If it’s necessary to do so we will use legal means and the tax system in order to ensure that those who have deeper pockets, those who are responsible for the upkeep of the buildings pay, rather than the leaseholders.

He said the Government has a responsibility to help flat owners who are “innocent parties” with huge costs.

A message from the editor:

Thank you for reading. NationalWorld is a new national news brand, produced by a team of journalists, editors, video producers and designers who live and work across the UK. Find out more about who’s who in the team, and our editorial values. We want to start a community among our readers, so please follow us on Facebook, Twitter and Instagram, and keep the conversation going. You can also sign up to our newsletters and get a curated selection of our best reads to your inbox every day.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.