Income tax changes 2022: what was said about cut in mini budget, when will it take effect, will I benefit?

and live on Freeview channel 276

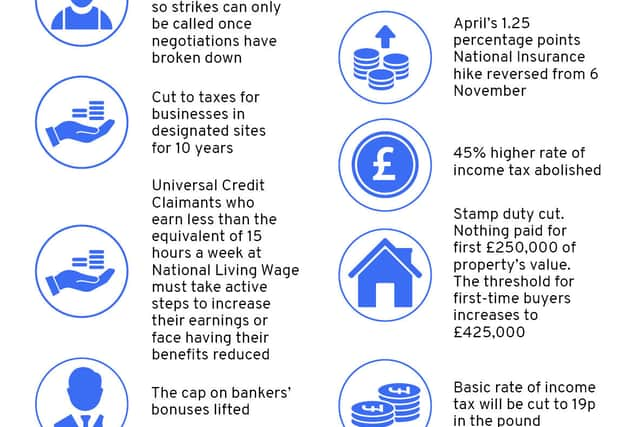

Kwasi Kwarteng has scrapped the top rate of income tax for the highest earners as he set out his plan to boost economic growth.

The Chancellor told the House of Commons in his mini-budget on Friday (23 September) that he will “abolish” the 45% additional rate of tax altogether.

Advertisement

Hide AdAdvertisement

Hide AdIt comes as part of a package of measures announced to grow the UK economy, tackle energy costs to bring down inflation, and improve living standards across the country.

The mini-budget confirmed the cap on bankers’ bonuses, a cut to stamp duty and a clamp down on trade unions, with Mr Kwarteng arguing that tax cuts are “central to solving the riddle of growth”.

The Chancellor also reiterated the importance of people keeping more of what they earn, incentivising work and enterprise.

What changes will be made to income tax?

Mr Kwarteng said the UK’s additional rate of income tax at 45% is higher than the headline top rate in other G7 countries and so he plans to scrap it altogether.

Advertisement

Hide AdAdvertisement

Hide AdThe additional rate of tax will be abolished from April 2023 and in its place will be a single higher rate of income tax of 40%.

The policy removes the UK’s previous top rate tax, which was higher than countries like Norway, USA and Italy, and is designed to attract the best and the brightest to the UK workforce, helping businesses innovate and grow.

He told MPs: “I’m not going to cut the additional rate of tax today. I’m going to abolish it altogether.

“From April 2023 we will have a single higher rate of income tax of 40%. This will simplify the tax system and make Britain more competitive.

Advertisement

Hide AdAdvertisement

Hide Ad“It will reward enterprise and work. It will incentivise growth. It will benefit the whole economy and the whole country.

“And, Mr Speaker, after all, this only returns us to the same top rate we had for 20 years – including the entire time the Opposition was last in power – bar one month.”

The Chancellor also announced a 1p cut to the basic rate of income tax one year earlier than planned, with the rate to be cut to 19% from April 2023.

How will I benefit from the tax cut?

The 1p cut to the basic rate of income tax will mean that 31 million people will be better off by an average of £170 per year.

Advertisement

Hide AdAdvertisement

Hide AdDue to the combined impact of the reversal of the HSCL and the reduction of the Income Tax Basic Rate, someone working full time on the current National Living Wage will see a tax cut of over £100.

Mr Kwarteng told the Commons: “I can announce today that we will cut the basic rate of income tax to 19p in April 2023 – one year early.

“That means a tax cut for over 31 million people in just a few months’ time. This means we will have one of the most competitive and pro-growth income tax systems in the world.”

The changes also mean that from April, the 629,000 earners getting more than £150,000 a year will no longer pay the top income tax rate of 45% and will instead pay the 40% applicable to those on over £50,271.

Advertisement

Hide AdAdvertisement

Hide Ad

Concluding his mini budget, the Chancellor promised to prioritise growth, adding that the the plans set out today will increase both prosperity and living standards.

He said: “We won’t apologise for managing the economy in a way that increases prosperity and living standards. Our entire focus is on making Britain more globally competitive – not losing out to our competitors abroad.

“The Prime Minister promised we would be a tax-cutting government. Today, we have cut stamp duty, we have allowed businesses to keep more of their own money to invest, to innovate, and to grow, we have cut income tax and national insurance for millions of workers, we are securing our place in a fiercely competitive global economy with lower rates of corporation tax and lower rates of personal tax.

“We promised to prioritise growth. We promised a new approach for a new era. We promised to release the enormous potential of this country. Our growth plan has delivered all those promises and more.”

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.