Mini budget 2022: what experts are saying about Kwasi Kwarteng’s plans to cut income tax and stamp duty

and live on Freeview channel 276

Kwasi Kwarteng today (23 September) unveiled a mini budget which outlines the Government’s plans to help families and businesses with skyrocketing energy bills.

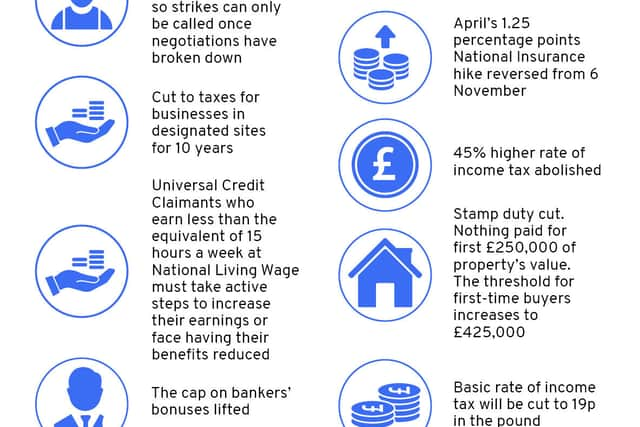

The Chancellor’s announcement included a range of significant tax cuts - to income tax, national insurance and corporation tax - in addition to measures such as scrapping the cap on bankers’ bonuses, and tightening rules for those receiving Universal Credit.

Advertisement

Hide AdAdvertisement

Hide AdAccording to Mr Kwarteng, the new energy relief package will “turn the vicious cycle of stagnation into a virtuous cycle of growth” - and is representative of the fact that the Government is “on the side of the people”.

Some experts however have warned about the sharp rise in borrowing, and others have argued the numbers simply don’t “add up”. Here’s what’s been said.

Institute for Fiscal Studies

The Institute for Fiscal Studies claimed “the Chancellor announced the biggest package of tax cuts in 50 years without even a semblance of an effort to make the public finance numbers add up.”

Director Paul Johnson criticised the Government’s plans to borrow large sums of money at “increasingly expensive rates,” arguing it would put the country’s debt on an “unsustainable rising path.”

Advertisement

Hide AdAdvertisement

Hide Ad

He added that the new measures, which mark the “biggest tax cutting event since 1972”, also risk inflation and significantly higher interest rates.

Another issue for the Institute is the fact that Mr Kwarteng’s fiscal statement is not a full “Budget”. The Chancellor and Prime Minister did not want to wait for the usual autumn Budget Statement, where major decisions about tax and spending are usually announced, as they wanted to implement the Government’s new economic strategy as soon as possible.

What this means is that today’s announcements were not accompanied by an official analysis and forecast by the Office for Budget Responsibility, which Mr Johnson said was done to “avoid scrutiny”.

“Mr Kwarteng is not just gambling on a new strategy, he is betting the house,” Mr Johnson concluded.

Advertisement

Hide AdAdvertisement

Hide AdNational Association of Property Buyers

The National Association of Property Buyers (NAPB) has issued a warning about the Government’s plans to cut stamp duty.

While the organisation said the cuts will provide a “huge boost” to many house-hunters, and will see some 200,000 people taken out of paying stamp duty altogether, it has also warned that the measure will backfire if the Government does not address the supply issue in the housing market.

Spokesperson Jonathan Roland said: “Cutting stamp duty without enough housing stock is rather like shops announcing massive sales - then leaving their shelves empty for those flooding in through the doors.”

He explained: “There was a lack of detail on how housing supply will be increased. That is worrying.”

Advertisement

Hide AdAdvertisement

Hide AdHe argued that the Government’s announcements will cause a frenzy of first time buyers to try to get on the housing ladder, but because the supply is not there, those same people may see their chance to take their first steps onto the property ladder “pulled up even further out of reach.”

“I fear that the unfairness in the market is set to be ever more ‘baked in’,” Mr Roland confirmed.

However, the NAPB did praise some of the other “radical” measures introduced by the Chancellor - remarking that it seems the Government is “keen to make its mark and reward the country for years of hard work and prosperity.”

Mr Roland cited the “top-rate tax cuts” and “assistance for companies” as productive new measures, and said the mini-budget will succeed at “putting more money in people’s pockets.”

Advertisement

Hide AdAdvertisement

Hide AdInstitute of Chartered Accountants in England and Wales

The ICAEW held its cards a little closer to its chest - neither praising nor condemning the mini-budget.

Managing director of reputation and influence Ian Wright said the measures were “bold” and “ambitious” - but admitted the package was also a “real gamble on the economy and public finances.”

He said businesses will be pleased with the “pledges on investment and reform”, but that energy will remain a key challenge.

“Whether the boldness in approach turns to recklessness remains to be seen,” Mr Wright concluded.

Advertisement

Hide AdAdvertisement

Hide Ad

Martin Lewis - Money-Saving Expert

Martin Lewis’ response was similar to the ICAEW. He wrote on Twitter that the mini-budget was “staggering” - drawing attention to the Government’s plans to borrow “huge” sums of money at the same time as cutting taxes.

He continued: “It’s all aimed at growing the economy. I really hope it works. I really worry what happens if it doesn’t.”

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.