Mini budget 2022: what did Kwasi Kwarteng say and how will it affect me - from stamp duty to income tax cuts

and live on Freeview channel 276

Chancellor Kwasi Kwarteng has today (23 September) unveiled a mini budget which experts say includes one of the biggest tax cuts the country has seen in the last 30 years.

The UK will see significant cuts to national insurance and corporation tax, and the cap on bankers’ bonuses is to be scrapped.

Advertisement

Hide AdAdvertisement

Hide AdThis is the first budget announced since Liz Truss became Prime Minister, and comes as the Government tries to limit the impact of skyrocketing energy bills on households and families.

So what exactly is in the new mini budget, what did the Chancellor of the Exchequer say, what does it all mean?

Here’s what you need to know.

What is a mini budget?

Today’s announcement, which the Government has called a “fiscal event”, has been dubbed a “mini budget” by the media.

This is because major decisions about tax and spending, which are normally made twice a year, come in the form of an autumn Budget Statement and a Spring Statement.

Advertisement

Hide AdAdvertisement

Hide AdThe measures included in Mr Kwarteng’s “mini budget” are on that kind of scale, with policies worth billions of pounds, but the new Prime Minister does not want to wait for the full Budget to implement the Government’s new economic strategy.

One of the key differences is that today’s announcements will not be accompanied by an official analysis of the impact on the country’s economy, usually provided by the Office for Budget Responsibility.

A full-scale Budget is expected later this year, but no date has been announced as of yet.

What did Kwasi Kwarteng announce?

Mr Kwarteng said he wanted to assure those listening that “during the worst energy crisis in generations, this government is on the side of the people.”

Advertisement

Hide AdAdvertisement

Hide Ad“People need to know help is coming - and help is indeed coming,” he declared to the House of Commons.

The Chancellor then went on to outline a series of measures which the new government said will help “turn the vicious cycle of stagnation into a virtuous cycle of growth”.

1. Income tax cuts

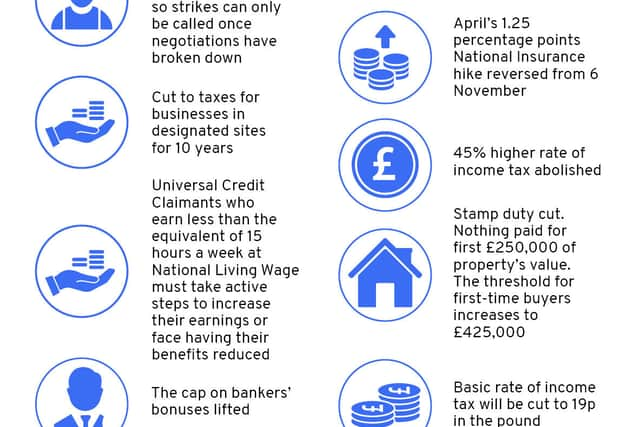

The planned cuts to the basic rate of income tax have been brought forward by a year. This means income tax will reduce to 19p in every £1 in April 2023.

According to estimates from the Treasury, this means 31 million people will get £170 more a year.

Advertisement

Hide AdAdvertisement

Hide AdThe Chancellor has also abolished the top rate of income tax for the highest earners. Those on more than £150,000 a year will no longer pay 45% but instead the lower 40% paid by those on over £50,271.

This will benefit workers on the highest salaries.

2. National Insurance rise reversed

Since April, workers have been paying more national insurance. - contributions increased by 1.25 percentage points. The Chancellor confirmed that this will be reversed on 6 November.

In practical terms, this means 28 million workers will have more money in their pockets - on average, an extra £330 a year in take-home pay.

3. A cut to stamp duty

Advertisement

Hide AdAdvertisement

Hide AdEffective from today, the Government has reduced the amount of tax people pay when buying property or land in England and Northern Ireland.

This means buyers no longer have to pay stamp duty on the first £250,000 of a property (up from £125,000), and first time buyers no longer have to pay on the first £425,000 of a property (up from £300,000).

According to Mr Kwarteng, this means 200,000 people will be taken out of paying stamp duty altogether.

4. Energy price freezes

Liz Truss previously announced that the energy price cap will be frozen at £2,500 a year for a typical home, stopping it from rising to £3,549 in October and to around £5,000 in January.

Advertisement

Hide AdAdvertisement

Hide AdThe plan is set to last for two years from 1 October, and will reportedly save the average household £1,000 a year amidst the spirally cost of living crisis.

Today, Mr Kwarteng offered more detail on plans to pay for the package - revealing to the House of Commons that the energy bill relief scheme is likely to cost £60 billion for the six months from October.

Perhaps anticipating criticism, the Chancellor argued that the “heavy price of inaction would be far greater than the cost of these schemes.”

Combined with the £400 energy bill discount to all households, and the £800 discount to vulnerable ones, Mr Kwarteng said that the Government was saving households £1,400 (or £2,200 for those eligible). He also claimed these measures will reduce inflation by five percentage points.

5. Caps on bankers’ bonuses axed

Advertisement

Hide AdAdvertisement

Hide AdIn a controversial move, Mr Kwarteng also confirmed plans to scrap the cap on bankers’ bonuses. The cap previously limited how much extra money bankers could earn.

Defending his decision, the Chancellor said: “A strong UK economy has always depended on a strong financial services sector. We need global banks to create jobs here, invest here, and pay taxes here in London, not Paris, not Frankfurt, not New York.”

He also claimed the bonus cap did not actually fulfil its intention, instead only working to “push up the basic salaries of bankers, or drive activity outside Europe.”

“It never capped total remuneration, so let’s not sit here and pretend otherwise,” he concluded.

6. Benefits rules tightened

Advertisement

Hide AdAdvertisement

Hide AdRules for those receiving Universal Credit will be harsher. The Chancellor said that people must be fulfilling job search commitments, such as taking active steps to get more or better paid work, or risk having their benefits reduced.

He also said jobseekers over 50 will be given extra time with work coaches to help them return to the job market.

7. Cracking down on strikes

In the mini-budget, Mr Kwarteng also took aim at striking workers. He announced legislation to force trade unions to put pay offers to a member vote, meaning strikes can only be called once negotiations have fully broken down.

The Government will also force transport companies to maintain a minimum level of service during strike action.

Advertisement

Hide AdAdvertisement

Hide Ad“It is simply unacceptable that strike action is disrupting so many lives,” the Chancellor said. “Other European countries have Minimum Service Levels to stop militant trade unions closing down transport networks during strikes. So we will do the same.”

8. Duty rises cancelled

Visitors from overseas will enjoy VAT-free shopping. Mr Kwarteng also confirmed that planned increases in duties on beer, cider, wine and spirits will be cancelled.

9. Corporation tax hike cancelled

A planned increase in corporation tax on big business profits, which in April was due to rise from 19% to 25%, has been scrapped.

The former Chancellor Rishi Sunak announced the hike after he accepted the previously low rate had failed to boost investment, but Mr Kwarteng has now confirmed the levy will stay at the lowest rate, at a cost of £19 billion.

Advertisement

Hide AdAdvertisement

Hide AdHe said: “It is businesses that employ most people in this country. It is businesses that invest in the products and services we rely on.

“This will plough almost £19 billion a year back into the economy. That’s £19 billion for businesses to reinvest, create jobs, raise wages, or pay the dividends that support our pensions.”

What has the response been?

Shadow Chancellor Rachel Reeves told the House of Commons that Mr Kwarteng’s mini-budget was an “admission of 12 years of economic failure” - referring to the amount of time the Conservatives have been in government.

She criticised the Government for not introducing more windfall taxes on the “eye-watering profits of energy giants”, and argued that - as the plans will be paid for by borrowing - “working people will be left to pick up the bill.”

Advertisement

Hide AdAdvertisement

Hide AdThe Leeds West MP continued: "Borrowing is higher than it needs to be, just as interest rates rise. And yet the Chancellor refuses to allow independent economic forecasts to be published, which would show the impact of this borrowing on our public finances, on growth, and on inflation. It is a budget without figures, a menu without prices. What has the Chancellor got to hide?"

Prior to the mini-budget announcement, some economists also warned about the sharp rise in borrowing. The Institute for Fiscal Studies for instance said the strategy to drive growth was “a gamble at best” and that ministers risked putting the public finances on an “unsustainable path”.

This comes after the Bank of England yesterday (22 September) indicated it believes the country’s economy is already in recession.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.