National Insurance changes: how will 2024 UK NI Contributions change affect me, what is it - rates gone down

The New Year saw a cut to national insurance, as the main rate of national insurance contributions (NICs) was cut by two percentage points, from 12% to 10%, on 6 January.

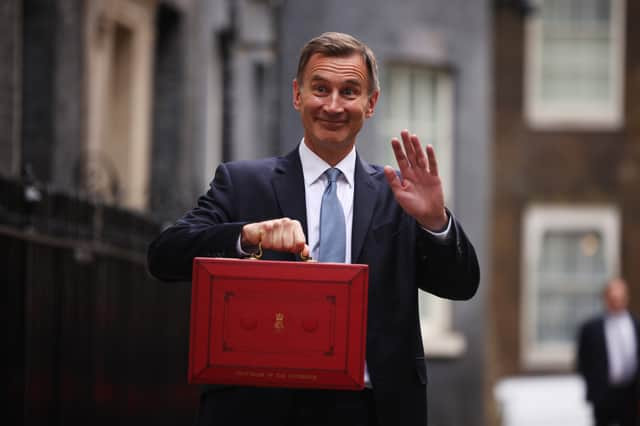

Chancellor Jeremy Hunt said the pre-election cut means families with two earners will be nearly £1,000 better off. But the move was called a “raw deal” by Labour, and economists said many households are still facing the burden of high taxes.

Though the changes came in at the start of the month, it's only as we reach the end of the month and employers' various pay days that employees will start to see them reflected in their payslips.

Here is everything you need to know about it.

What is National Insurance?

National Insurance is a tax most working people pay out of their monthly pay packets. These contributions are used by the government to fund state pensions as well as other state benefits, such as Universal Credit.

What you pay depends on how much you earn and whether you’re employed or self-employed, but everyone can earn a certain amount of money before having to pay anything. This is known as the National Insurance threshold.

What are the changes?

As of 6 January, the government has reduced the main rate of national insurance contributions (NICs) for employees, decreasing it from 12% to 10%, an adjustment announced by chancellor Jeremy Hunt in the November autumn statement.

The revised "class 1" contributions apply to individuals aged 16 to state pension age earning more than £242 per week from a single job. Employers automatically deduct these contributions.

Under the updated rates, employees will now contribute 10% on earnings between £242 and £967 per week. For earnings exceeding £967 per week (equivalent to an annual income of £50,284), the contribution rate is 2%.

The Treasury touts this as the "largest ever cut to national insurance," benefiting approximately 27 million workers.

How much will the changes save me?

The Treasury has previously said that cutting the main rate for employees is a tax cut worth £450 for the average employee on £35,400 in 2024/25.

Later in the year, the government is also cutting taxes for the self-employed from 6 April 2024. The government is reducing the main rate of Class 4 self-employed NICs from 9% to 8%, and abolishing the "needlessly complex" Class 2 self-employed NICs.

It says these changes will benefit around 2 million self-employed individuals and result in an average self-employed person on £28,200 saving £350 in 2024/25.

Here’s an estimation of what you now pay annually in NICs depending on how much you earn (H/T NerdWallet):

- £20,000: you will pay £743 (£148.60 less than the £891.60 due in 2023/24)

- £30,000: you will pay £1,743 (£348.60 less than the £2,091.60 due in 2023/24)

- £40,000: you will pay £2,743 (£548.60 less than the £3,291.60 due in 2023/24)

- £50,000: you will pay £3,743 (£748.60 less than the £4,491.60 due in 2023/24)

- £60,000: you will pay £3,964.60 (£754.00 less than the £4,718.60 due in 2023/24)

Will the changes really save me money?

While the change to the main rate of NICs will save most employees money over the year, finance experts and economists have said the national insurance boost will be counteracted by frozen tax thresholds, which have been pushing people into higher tax brackets.

The Institute for Fiscal Studies said personal taxes were rising despite the NIC cut, and said in a briefing: “This year will see both the national insurance contributions (NICs) rate cut and a tax increase via the planned freeze in income tax and NICs thresholds and allowances in April.

"Put the two together and this is, overall, actually a tax increase. An employee earning £35,000 will gain about £130 more from the NICs cut than they lose from this April’s freeze in thresholds.

"Those with slightly higher earnings will gain a bit more than this, whereas taxpaying employees earning less than £29,000 will almost all lose out.”

There is speculation that further tax cuts could be announced in the spring budget on 6 March, as Prime Minister Rishi Sunak prepares for a general election later this year. That could be Hunt’s last chance to introduce major tax and spending changes before voters go to the polls.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.