Homeowners face mortgage hikes up to £14,000 a year, Labour warns - worst hit areas

and live on Freeview channel 276

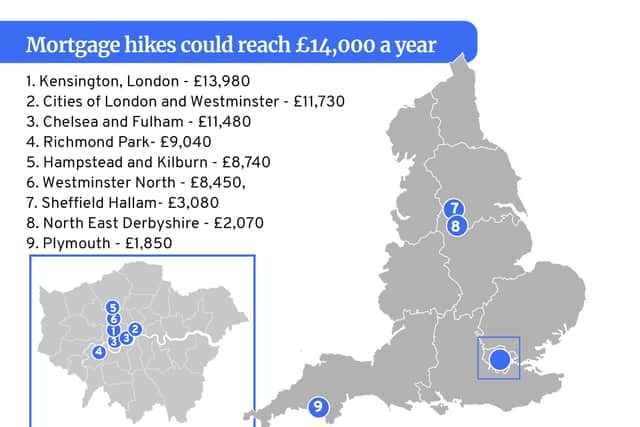

Homeowners could face mortgage hikes of up to £14,000 a year as they come off low fixed-rate deals, Labour has warned.

Analysis by the party shows predicted annual increases in costs for a median house purchase at 80% mortgage in every constituency in the UK.

Advertisement

Hide AdAdvertisement

Hide AdThe highest rises are expected in Kensington, London where costs are set to soar by £13,980.

The cities of London and Westminster, followed by Chelsea and Fulham, are also expected to face increased prices, with possible rises of £11,730 and £11,480 respectively.

Richmond Park could see mortgages go up by £9,040, Hampstead and Kilburn by £8,740 and Westminster North by £8,450, according to the analysis.

Elsewhere, Sheffield Hallam is predicted to see mortgages rise by £3,080, North East Derbyshire by £2,070, and Plymouth, Sutton and Devonport by £1,850.

Advertisement

Hide AdAdvertisement

Hide AdHomeowners in Rhondda and Easington are to see the lowest increases at £1,030 and £910 respectively.

‘The Tory mortgage penalty is devastating’

Shadow Chancellor Rachel Reeves said the country is “buckling under 13 years of Conservative mismanagement, and its families being asked to pay more on their mortgage once again.”

She added: “The Tory mortgage penalty is devastating for family finances and is holding back our economy. People are asking themselves whether they or their family are better off under the Tories. The answer is no.

“By stabilising the economy, making it stronger and getting it growing, Labour will stop us lurching from crisis to crisis, and make Britain thrive again.”

Advertisement

Hide AdAdvertisement

Hide Ad

Reeves is due to visit estate agents in Finchley and Golders Green on Thursday (2 February) to discuss how soaring mortgages are impacting the business, homeowners and buyers.

In Finchley and Golders Green the cost of a typical mortgage is expected to go up by £7,490 a year.

The Office for National Statistics has predicted more than 1.4 million households are facing the prospect of interest rate rises when they renew their fixed-rate mortgages this year.

A string of Bank of England base rate hikes have taken place over the past year, but borrowers on fixed-rate mortgages were sheltered from their immediate impact - meaning some may get a shock when they come to renew.

Advertisement

Hide AdAdvertisement

Hide AdA senior Tory source said: “Under Labour, the number of first-time buyers fell to the lowest ever, the number of homes built the lowest ever, and homeownership was put out of reach for millions.

“The Labour Party… offer no real change on the issues that matter to the British people. We have a real plan to half inflation this year and build a better Britain.”

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.