UK tax changes 2022: list of taxes for new tax year, including national insurance, council tax and car tax

and live on Freeview channel 276

The new UK tax year for 2022/23 has officially kicked off.

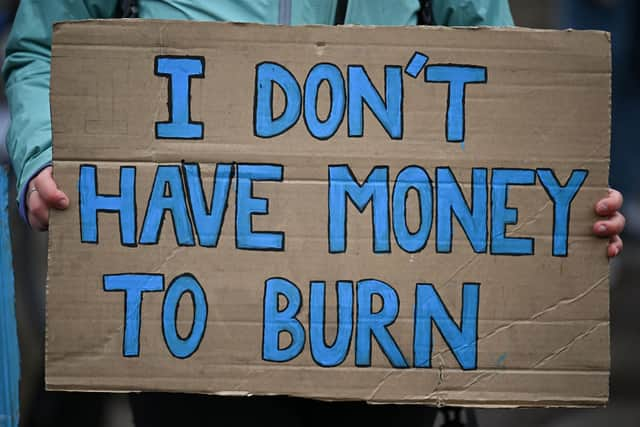

Every new financial year brings changes to taxes and bills with it, but these alterations have been met with more scrutiny that usual in 2022 as a result of the worst cost of living crisis for decades.

Many of the changes came in on 1 April - a date that’s become known as ‘Bleak Friday’ as it saw a swathe of tax and bill hikes kick in that have hit household budgets up and down the country.

Advertisement

Hide AdAdvertisement

Hide AdBoris Johnson’s administration says the rises are necessary to pay for the massive public spending increases seen during the Covid pandemic, for example through the furlough scheme, as well as the backlog in NHS services.

So what tax changes has the new financial year brought with it?

NationalWorld has put together a roundup of all the major taxes that have been altered in April and how will they affect you.

How has council tax changed?

Council tax pays for all the services and infrastructure your local authority provides, like bin collections and pothole filling, as well as for the police and fire service.

Advertisement

Hide AdAdvertisement

Hide AdFrom 1 April, councils across the UK were permitted to raise their levy by a maximum of 5%, with the average increase expected to be 3.5% until March 2023.

Some households in England and Wales will be able to cancel out at least some of this increase at some point between April and September thanks to the Government’s one-off £150 council tax rebate.

Rishi Sunak announced the measure in February after it became clear that the cost of living crisis was getting worse.

To find out if you’re eligible for the rebate, NationalWorld has a piece that runs you through UK council tax bands.

Advertisement

Hide AdAdvertisement

Hide AdThe devolved administrations in Scotland and Northern Ireland have not introduced the measure but have received extra funding under the Barnett formula.

How much has car tax gone up by?

While this won’t hit all drivers immediately, as when you pay your car tax is determined by when you put your vehicle on the road, the car tax - or Vehicle Excise Duty - rate changed on 1 April.

It went up in line with the Retail Price Index (RPI) - an unofficial yardstick that’s used to track inflation in some parts of the economy.

This means that drivers, if they pay car tax at all, can expect to have to shell out between £10 and £15 extra compared to what they paid in the previous tax year.

Advertisement

Hide AdAdvertisement

Hide AdFor a full breakdown of how car tax is changing, check out this piece from NationalWorld’s motoring writer Matt Allan.

How big is the fuel duty cut?

Fuel Duty has been cut - although, given its introduction coincided with Rishi Sunak’s Spring Statement on 23 March, it does not fully align with the new tax year.

The Chancellor has chopped 5p per litre off the petrol tax, taking it from 57.95p per litre to 52.95p per litre until March 2023.

The combination of fuel duty and VAT currently makes up 52% of forecourt prices per litre of petrol and 50% for diesel.

Advertisement

Hide AdAdvertisement

Hide AdWhere this cut is being passed onto consumers, it could reduce the cost of filling an average family car by around £3.

But, given pump prices have been at record highs as a result of the Russia-Ukraine war, Mr Sunak has been criticised for not going further with the cut.

The cut to fuel duty has also not yet been reflected in all pump prices as some retailers fear they could lose out until they can purchase oil at a lower price.

What’s changed with VAT?

We pay value added tax (VAT) on almost everything we buy.

But the rate of VAT was temporarily lowered for the hospitality industry by Rishi Sunak from the standard 20% to 5% because the Covid pandemic wiped out almost all of its sales.

Advertisement

Hide AdAdvertisement

Hide AdThis VAT rate rose to 12.5% in October 2021 as restrictions eased and has now gone back up to the full 20% again (as of 1 April).

It means the cost of eating out or staying in a hotel is likely to go up.

How will National Insurance change?

Back in September 2021 - before the cost of living had become an issue - the Government announced it would be raising National Insurance contributions by 1.25p in the pound.

This increase will hit paypackets from 6 April when the new tax year begins.

Advertisement

Hide AdAdvertisement

Hide AdBoris Johnson and Rishi Sunak said they made the move because they felt it was the best way to raise funds to help the NHS recover from the Covid pandemic.

It means a typical basic rate taxpayer earning £24,100 would contribute £3.46 a week, while a higher rate taxpayer on £67,100 would pay £7.15 a week, according to figures released by Downing Street.

In light of the cost of living crisis, Rishi Sunak sought to reduce the hit faced by the poorest UK households by increasing the threshold they can earn before they have to pay the tax in his Spring Statement.

But this measure will not come in until July 2022.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.