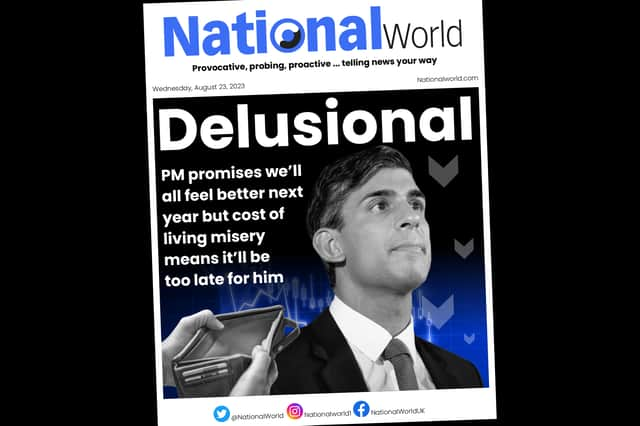

Tone-deaf Rishi Sunak says ‘we’ll feel better off next year’ but that will be too late to save his premiership

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

and live on Freeview channel 276

Don’t worry - you may be feeling the squeeze at the moment, with double-digit food inflation, huge energy bills and rocketing mortgage rates - but Rishi Sunak says next year we’ll “all feel better off”.

The Prime Minister was buoyed after the latest ONS figures showed inflation was at its lowest level since February 2022, when Russia invaded Ukraine. After returning from holiday in California, Sunak told the Times he was “really optimistic” about the future, and that the “plan is working” to bring down inflation.

Advertisement

Hide AdAdvertisement

Hide AdWhile it’s the PM’s job to sound positive, Boris Johnson famously declared 2020 was going to be a fantastic year a few months ahead of the pandemic, from multi-millionaire Sunak, there’s a danger of it sounding a bit tone deaf or even delusional.

The cost of living crisis has affected almost everyone in the country, with first energy bills sky-rocketing, then food prices and now rent and mortgage rates, after Sunak’s predecessor Liz Truss’ disastrous mini-budget.

Around 2.4 million fixed-term deals will expire before the end of 2024, and those homeowners will see their monthly payments increase significantly. When asked about this on LBC, by a dad-of-four whose mortgage is going up from £1,500 to £2,800, Sunak merely said to “talk to his bank” and told him “a typical payment” would go up by £200.

But perhaps this is not surprising advice from from a man who lives in a manor house in North Yorkshire, owns a £5.5million penthouse in Santa Monica and two other pads in swish Kensington.

Advertisement

Hide AdAdvertisement

Hide AdAnd once again, when speaking to the Times, Sunak sounded out of touch. Even if inflation does come down to near the Bank of England’s target of 2%, it will take a while to be felt. Food inflation is still almost 15%, while analysts expect interest rates to stay above 5% into 2025.

Compare the Market announced that the average annual car insurance policy has gone up to £743, a whopping £208 or 39% increase year-on-year. Maybe we’ll feel better off compared to the peak of the cost of living crisis, but I doubt anyone will feel great about their finances. Maybe that’s something a man, who doesn’t even appear to know how a contactless card works, wouldn’t understand.

Beyond the issue of whether people will feel better off, is the question of whether inflation will keep coming down. While the CPI reduced, core inflation - which removes volatile areas such as food and energy bills - remained static at 6.9%. This is used to indicate how embedded inflation is in the economy, and in the UK it is proving to be quite sticky.

So despite Sunak sounding positive, many economists still think his promise to halve inflation by the end of the year is in jeopardy.

Advertisement

Hide AdAdvertisement

Hide AdHeidi Karjalainen, from the IFS, said: “The Prime Minister’s target to halve the rate of inflation by the end of the year was always a little odd as there is only so much the Treasury can do to influence the pace of price increases.

“When the target was set, the Prime Minister may have hoped he could rely on falling energy prices to do most of the work to hit it. However, the stubbornly high rate of price inflation for goods and services other than food and energy has put the target in jeopardy.”

Politically, next year - which will almost certainly be an election year - may be too late to save Sunak’s premiership. The Conservatives have presided over 13 years of stagnant growth with an array of ineffective fiscal policies.

During austerity, Cameron and Osborne kept the purse strings tight while interest rates were low and borrowing was cheap, and then when inflation was on the rise, the UK’s shortest serving Prime Minister, Liz Truss, announced billions of pounds of borrowing to cover tax cuts, which sent the markets into meltdown.

Advertisement

Hide AdAdvertisement

Hide AdAnd this opinion is reflected in the polls. According to YouGov’s tracker a whopping 76% people think the government is handling the economy badly, with just 17% thinking Sunak and Hunt are doing a good job.

An even higher proportion of people think the Tories are handling inflation badly, and worryingly for Sunak almost two-thirds of people think it’s the biggest issue facing this country.

Things may look up slightly in 2024, but after more than 13 years it’ll be too late for Sunak and the Tories.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.