Which utility bills are going up in April 2023? Energy bills, council tax, broadband deals hikes explained

and live on Freeview channel 276

With the news that inflation and interest rates have gone up at the same time as wages have declined in real terms, the cost of living crisis looks like it’s very much here to stay.

The rate of price rises grew to 10.4% in February as a result of soaring food costs - increases that have since been underlined by a separate measure of food prices from the British Retail Consortium and analytics firm Nielsen. The Bank of England has also implemented its 11th consecutive interest rates hike - a move which means mortgages have become much more expensive for many UK households.

While inflation is expected to fall over the course of 2023, it will still mean shelf prices for everyday necessities will remain much higher than they were a year ago. Indeed, the Office for Budget Responsibility (OBR) - the public body tasked with reviewing the government’s spending plans - said in the wake of the Spring Budget that it expects living standards will fall to their lowest levels since the 1950s.

Research has shown that many households are already struggling to get by - even those that contain key workers, like NHS staff. Despite this, several major monthly bills are set to rise sharply in April at the same time as taxes, such as income tax, are also set for a hike.

So, which household bills will be going up - and how much will they increase by?

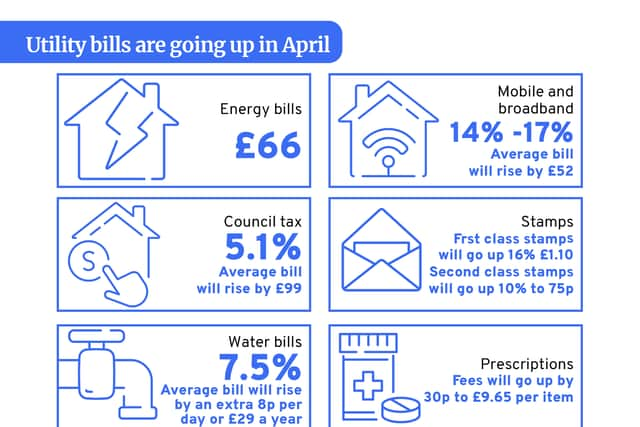

Energy bills

Although Jeremy Hunt announced in his Spring Budget that the energy price guarantee will remain at its current rate for another three months, energy bills will still go up from April. The reason for this is that the £400 energy bills support scheme, which has been applied to energy bills in £66 and £67 chunks over the winter months, ends after March.

So, while bills won’t rise by the 20% they would have gone up by had the energy price guarantee hike gone ahead as planned, the impact of that extra £66 is likely to be noticeable. The hike will be partially offset by the increasing likelihood of warmer weather, which will mean we’re less likely to put the heating on.

Council tax

The amount of money most people in Great Britain are going to have to pay to their local authority is set to go up by an average of 5.1% from April, according to official figures. It means the average bill will rise by £99 to £2,065.

It comes after the Chancellor Jeremy Hunt changed the rules for how much councils can hike the tax without triggering a local referendum. To see how much your bill is rising, you can visit NationalWorld’s council tax calculator.

This year’s bill will also feel steeper than last year’s because households in bands A to D received a one-off £150 rebate in 2022 - a payment that is not being repeated this year. However, the government has announced it will be providing other financial support to the UK’s most vulnerable households over the coming weeks.

If you think your home is in too high-a-band, you can challenge the rate you pay and, if you live alone, you can apply for a discount from your council.

Water bills

Households in England and Wales are set to see their water bills rise by an average of 7.5% from April - the biggest increase in almost 20 years. This hike will amount to an extra 8p per day or £29 a year.

While this figure doesn’t sound like much, a typical daily rate of £1.23 will amount to an annual bill of £448. Suppliers have argued they need to increase bills to enable them to pay for vital infrastructure upgrades. But their operating models have come in for heavy criticism as a result of poor environmental practices and how much they pay their bosses.

The water regulator Ofwat is trialling a new system with southern England supplier Affinity Water that will charge households a lower rate if they tend to use less water, and progressively higher prices if they use greater volumes. Only 1,500 homes are taking part in the trial, but such a system could be rolled out more widely in future if it is deemed a success.

Mobile and broadband

All mobile and broadband customers will be subjected to hikes of 14% to 17% from April. It means your annual bill could rise by three-figures if you’re on a package containing several different aspects, such as spot and TV. Consumer watchdog Which? has calculated that bills for low-income households could rise by up to £77 a year, or £52 on average.

The reason for the rise is that most communications companies tend to attach their annual bill increases to the Retail Prices Index (RPI) - a measurement for inflation that tends to track higher than official benchmark the CPI - and add an additional percentage on top. But it come after a Which? satisfaction survey of 4,000 people found the biggest broadband providers were providing a “mediocre at best” service.

You can beat the increases by opting for another deal if you’ve come to the end of your contract. You could also haggle with your supplier if your deal is nearly at its end. But if you’re stuck in the middle of a contract, the exit fees may make a switch too expensive (particularly given many can be in three-figures if you leave a year early).

Stamps

While stamps are not the everyday household cost they used to be given the prevalence of electronic communications, we’re still sending more than 5.5 billion letters every year. And it’s about to get more expensive to do so.

From Monday (3 April), the price of a first class stamp will go up 16% (15p) to £1.10, while second class stamps will become 10% (7p) more expensive at a price of 75p. Royal Mail has said the increase will allow it to ensure its operation “remains sustainable”.

Prescriptions

The price of prescriptions is set to rise for people in England from April. Fees will go up by 30p to £9.65 per item.

NationalWorld has written about how you can save money on the drugs you need to buy. These include checking whether it’s cheaper to prepay and whether your drug or age makes you exempt from any charges. It comes after research by the Office for National Statistics (ONS) found 10% of adults have reported taking less medication in a bid to cut down on prescription costs.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.